- Renting vs Buying a House in Abuja: The Great Debate

- The True Cost of Renting in Abuja (2026)

- The True Cost of Buying a House in Abuja (2026)

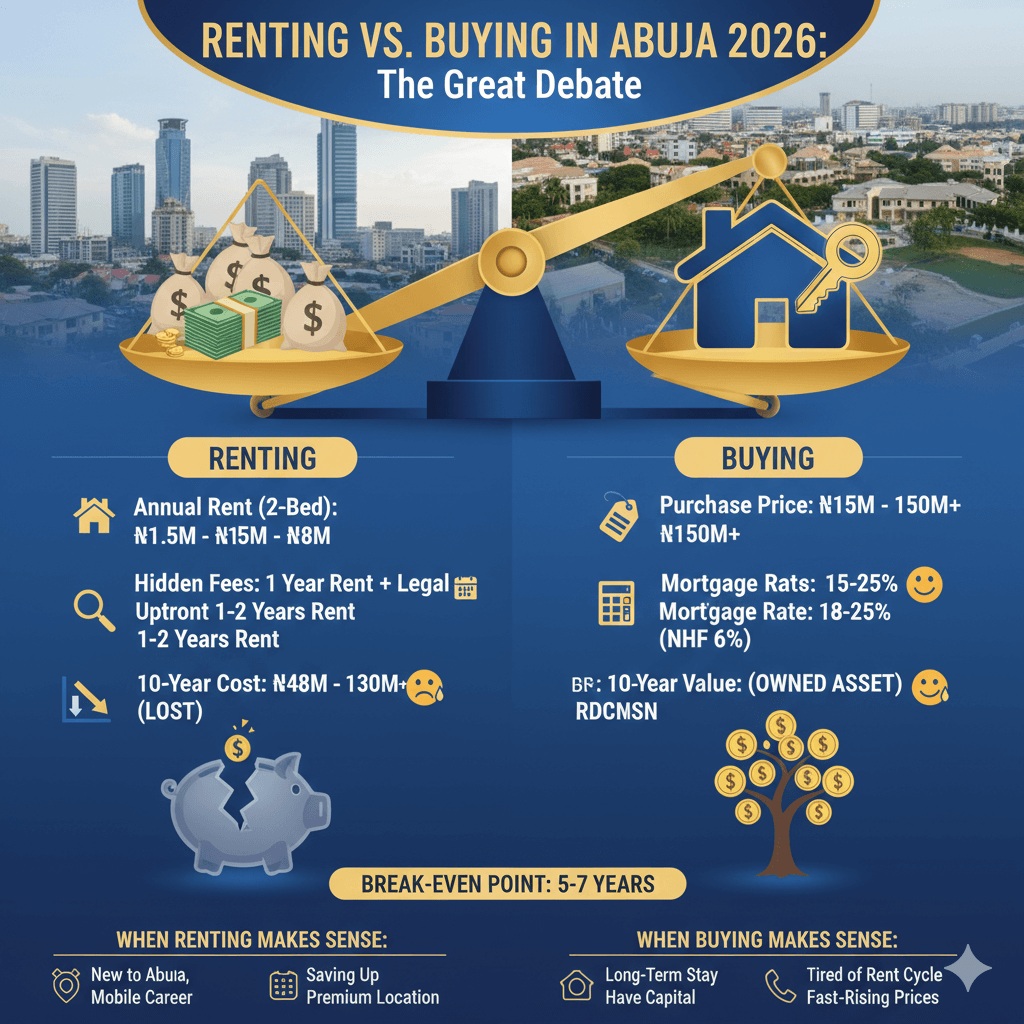

- Renting vs Buying: Side-by-Side Comparison

- When Renting Makes More Sense in Abuja

- When Buying Makes More Sense in Abuja

- The Hybrid Strategy: Buy in One Area, Rent in Another

- Best Areas to Buy vs Rent in Abuja

- Making Your Decision: A Practical Framework

- Frequently Asked Questions

- Is it cheaper to rent or buy a house in Abuja?

- How much rent do you pay per year in Abuja?

- Can I get a mortgage to buy a house in Abuja?

- What is the average house price in Abuja?

- Is Abuja property a good investment?

- How many years of rent equals buying a house in Abuja?

- What are the hidden costs of buying a house in Abuja?

- Should I rent or buy if I am new to Abuja?

- Continue Reading

Renting vs Buying a House in Abuja: The Great Debate

Every year, thousands of professionals, families, and investors moving to Abuja face the same question: should I rent or buy a house? It is a decision that affects your finances for decades, and Abuja’s property market makes the answer far less straightforward than you might expect.

On one hand, Abuja’s rental market has experienced a sustained surge over the past few years, with landlords demanding ever-higher rents paid one to two years upfront. On the other hand, property prices in the Federal Capital Territory continue to appreciate, meaning that every year you delay buying, the entry cost climbs higher.

The numbers are striking. A tenant paying ₦3M per year in rent will hand over ₦30M in just 10 years with absolutely nothing to show for it. Meanwhile, a buyer who purchased a ₦30M property in Lugbe five years ago likely owns a home now worth ₦45M or more. But buying demands significant upfront capital that many people simply do not have.

This guide breaks down the real costs of renting versus buying in Abuja in 2026, compares them side by side, and helps you determine which option makes more financial sense for your specific situation. Whether you are a first-time renter, a seasoned tenant tired of annual rent increases, or an investor weighing the numbers, this analysis will give you the clarity you need.

The True Cost of Renting in Abuja (2026)

Renting in Abuja is not as simple as paying a monthly fee and moving on. The cost structure in Nigeria’s capital is unique, and understanding the full picture is essential before you can compare it fairly against buying.

Average Rent by Area and Property Type

Rental prices in Abuja vary dramatically depending on location and property type. Here is what you can expect to pay in 2026:

2-Bedroom Flats:

- Affordable areas (Lugbe, Kubwa, Dawaki): ₦1.5M – ₦3M per year

- Mid-range areas (Gwarinpa, Jahi, Life Camp): ₦2.5M – ₦4.5M per year

- Prime areas (Maitama, Asokoro, Wuse 2): ₦4M – ₦8M per year

3-Bedroom Flats:

- Affordable areas: ₦2.5M – ₦5M per year

- Mid-range areas: ₦4M – ₦7M per year

- Prime areas: ₦6M – ₦12M per year

3-Bedroom Detached/Semi-Detached Houses:

- Affordable areas: ₦3M – ₦6M per year

- Mid-range areas: ₦5M – ₦9M per year

- Premium areas (Maitama, Asokoro): ₦8M – ₦15M per year

You can browse current rental listings on our properties for rent page to see live pricing.

Hidden Costs That Inflate Your Rent

The figure your landlord quotes is rarely what you actually pay. Expect these additional costs:

- Agency fee: Typically equivalent to one year’s rent (yes, an entire year), sometimes 10% of the total rent

- Legal/agreement fee: ₦50,000 – ₦200,000 for tenancy agreement preparation

- Caution/security deposit: ₦100,000 – ₦500,000, often non-refundable in practice

- Service charge: ₦200,000 – ₦1.5M per year in estates with facilities

For a ₦3M/year apartment, your actual first-year outlay could reach ₦6.5M or more once all fees are included.

The Upfront Payment Problem

Unlike most countries where rent is paid monthly, Nigerian landlords in Abuja typically demand one to two years of rent upfront. This means a tenant renting a ₦3M/year flat must produce ₦3M to ₦6M in a single payment, plus agency and legal fees. This upfront burden is one of the biggest financial challenges for renters in Abuja and ironically makes the gap between renting and buying smaller than it appears.

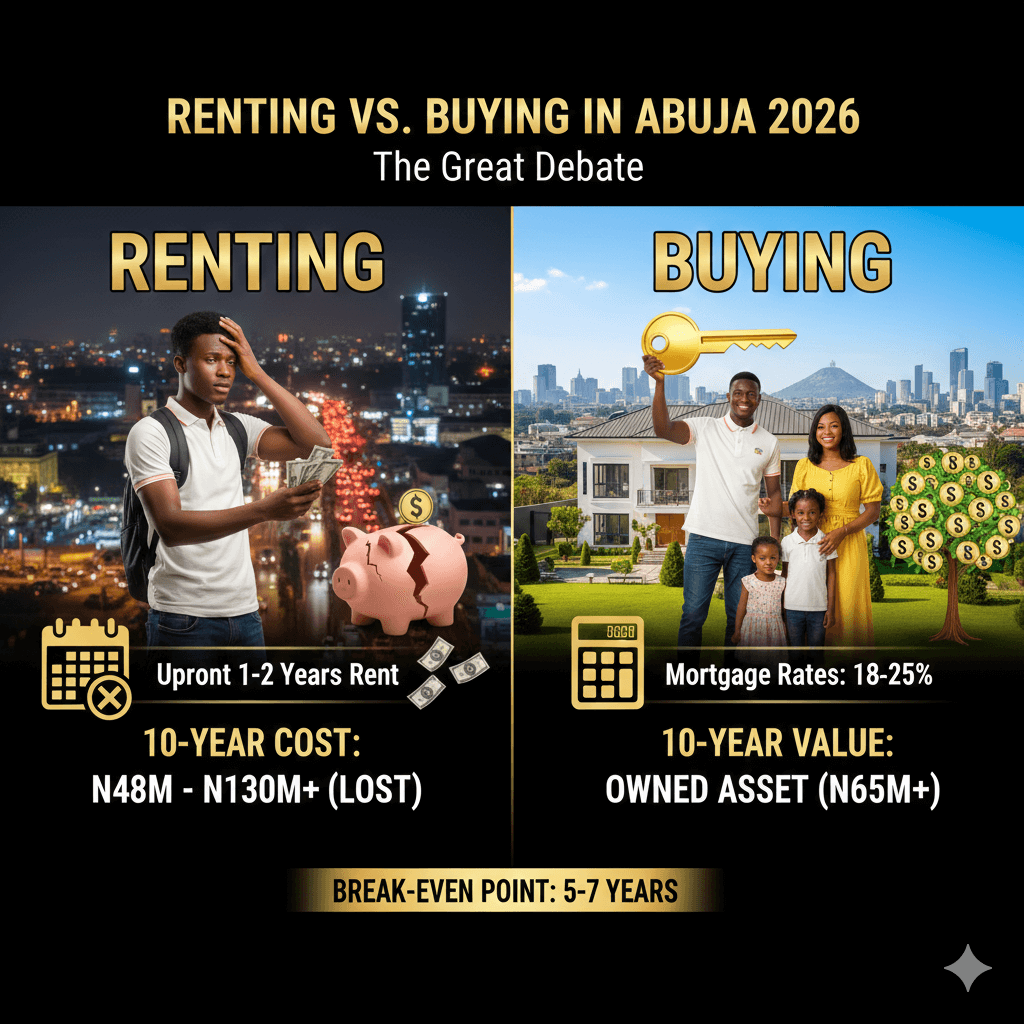

The 10-Year Renting Cost

Assuming modest annual rent increases of 10-15% (which is conservative in Abuja’s current market), a tenant paying ₦3M/year today will pay approximately ₦48M – ₦61M over 10 years. A tenant in a prime area starting at ₦8M/year could pay ₦130M or more over the same period. At the end of those 10 years, you own nothing. Every naira is gone.

The True Cost of Buying a House in Abuja (2026)

Buying a house in Abuja requires significant capital, but unlike rent, your money goes into an asset that you own and that typically appreciates over time. Here is what the numbers look like in 2026.

Property Prices by Area

Affordable areas (best entry points):

- Lugbe: ₦15M – ₦35M for 3-bedroom bungalows and semi-detached houses

- Kubwa: ₦18M – ₦40M for similar properties

- Dawaki, Karsana: ₦20M – ₦45M for newer developments

Mid-range areas:

- Gwarinpa: ₦45M – ₦90M

- Jahi, Life Camp: ₦50M – ₦100M

- Lokogoma, Gaduwa: ₦35M – ₦70M

Premium areas:

- Maitama: ₦150M – ₦500M+

- Asokoro: ₦120M – ₦400M+

- Wuse 2: ₦100M – ₦300M

For a detailed breakdown of property prices across all major areas, read our comprehensive guide to house prices in Abuja.

Additional Costs Beyond the Purchase Price

The sticker price is not the full cost. Budget for these additional expenses:

- Legal fees: 5-10% of the property price for title search, deed of assignment, and registration

- Agency/brokerage fee: 5% of the purchase price (sometimes negotiable)

- Consent fee (Governor’s Consent): Variable, can be 3-6% of the assessed value

- Survey and documentation: ₦200,000 – ₦500,000

- Renovation and repairs: ₦2M – ₦10M depending on the property condition

All told, expect to pay 15-25% above the purchase price in transaction and setup costs. A ₦40M house could cost you ₦46M – ₦50M before you move in.

The Mortgage Reality in Nigeria

Mortgages in Nigeria remain challenging. Commercial bank mortgage rates hover between 18% and 25% per annum, with tenures typically capped at 15-20 years. The National Housing Fund (NHF) offers rates as low as 6%, but the maximum loan amount is ₦15M, which buys very little in Abuja.

Most Abuja property purchases are made with cash, savings, or developer instalment plans rather than traditional mortgages. Some developers offer 6-24 month payment plans with manageable interest rates, making buying more accessible than bank mortgages alone would suggest.

The Upside: Equity and Appreciation

Abuja properties have historically appreciated at 8-15% annually in developing areas and 5-10% in established areas. A ₦30M property in Lugbe purchased in 2021 could be worth ₦50M – ₦55M today. Unlike rent, every naira you put into a property purchase builds wealth. Browse available houses for sale in Abuja to see what is on the market.

Renting vs Buying: Side-by-Side Comparison

This table puts the key factors next to each other so you can see exactly how renting and buying compare in Abuja’s current market.

| Factor | Renting | Buying |

|---|---|---|

| Upfront cost | 1-2 years rent + agency + legal fees | Full purchase price or mortgage down payment (20-30%) |

| Annual cost | Rent increases 10-15% yearly | Mortgage payments or zero if paid outright |

| Flexibility | Can relocate at end of lease | Tied to location (unless you rent it out) |

| Wealth building | None – money is spent | Equity grows + property appreciates 8-15%/year |

| Maintenance | Landlord’s responsibility (in theory) | Entirely your responsibility |

| Control over property | Limited – cannot modify significantly | Full control to renovate and customize |

| 10-year total cost | ₦30M – ₦80M+ (all lost) | ₦40M – ₦100M+ (invested in asset) |

| Tax benefits | None | None (Nigeria has no mortgage interest deduction) |

| Risk | Eviction, rent hikes, landlord disputes | Market downturn, title issues, construction defects |

When Renting Makes More Sense in Abuja

Despite the long-term financial advantage of buying, renting is genuinely the smarter choice in several common situations. There is no shame in renting strategically, and doing so can actually position you better for a future purchase.

You Are New to Abuja

If you have just relocated to Abuja for work or business, rent first for at least one to two years. Every neighbourhood in Abuja has a different character, commute pattern, and quality of life. Gwarinpa feels completely different from Jahi, and Wuse 2 is nothing like Kubwa. Renting lets you experience an area before committing millions of naira to it. Explore the Abuja area guides to start researching neighbourhoods.

Your Career Requires Mobility

If your job transfers you every two to four years, buying makes little financial sense. Transaction costs alone (legal fees, agency fees, consent fees) can consume 15-25% of a property’s value. You would need at least five years of appreciation just to break even on those costs. Military personnel, diplomats, oil and gas workers, and federal civil servants who rotate frequently are often better off renting.

You Cannot Afford to Buy Yet

If your savings are not sufficient for a property purchase, renting while aggressively saving is perfectly rational. The key word is aggressively. If you are renting and not saving towards a purchase, you are losing ground every year as property prices rise. Set a target, a timeline, and a savings plan.

You Need a Premium Location

If your work or lifestyle requires you to live in Maitama or Asokoro but you cannot afford the ₦150M+ price tag, renting at ₦8M – ₦12M per year gives you access to these areas at a fraction of the buying cost. You can live in a premium area while buying an investment property in a more affordable location.

You Are Waiting for a Specific Development

If you have your eye on a particular estate or development that is still under construction, renting nearby for a year or two while the project completes can be a smart interim strategy rather than buying something you do not really want.

When Buying Makes More Sense in Abuja

For many Abuja residents, buying is the clear winner, particularly if you meet certain criteria. Here is when you should seriously consider purchasing rather than continuing to rent.

You Plan to Stay Long-Term

If Abuja is your permanent base and you intend to stay for five years or more, buying almost always wins financially. Property appreciation alone can exceed your total rent payments over the same period, and you end up owning an asset. Read our complete guide to buying a house in Abuja to understand the full process.

You Have the Capital

If you have savings, a lump sum, or access to affordable financing, deploying that capital into Abuja real estate is one of the most reliable wealth-building strategies available in Nigeria. Property in the FCT has consistently appreciated over the past two decades, outpacing inflation in most years.

You Are Tired of the Rent Cycle

The annual scramble to produce one to two years of rent upfront is exhausting and financially draining. Many tenants find themselves in a cycle where each year’s rent payment prevents them from saving for a purchase. Breaking this cycle by buying, even in a more affordable area than you currently rent, is a transformative financial decision.

Prices in Your Target Area Are Rising Fast

Areas like Dawaki, Lokogoma, and parts of Lugbe have seen 15-20% annual appreciation in recent years as infrastructure improves and demand grows. If you are watching prices climb in your preferred area, every year you wait costs you money. The best time to buy in a rising market is as early as possible.

You Want Rental Income

Buying a property specifically to rent it out can generate 5-10% annual rental yield in Abuja, depending on the area and property type. This is passive income that grows as rents increase, while your asset simultaneously appreciates. If you already own your primary residence or are comfortable renting where you live, an investment property is a powerful wealth-building tool.

The Hybrid Strategy: Buy in One Area, Rent in Another

Here is a strategy that savvy Abuja residents increasingly use: buy an investment property in an affordable, high-growth area while renting in the area where you actually want to live. This gives you the best of both worlds.

How It Works

Instead of paying ₦8M per year to rent in Wuse 2 with nothing to show for it, or stretching to buy a ₦150M+ property there, you take a middle path:

- Buy a property in an affordable area like Lugbe or Dawaki for ₦25M – ₦35M

- Rent it out for ₦1.5M – ₦2.5M per year

- Continue renting where you want to live, using the rental income to offset part of your rent

Example Calculation

Suppose you buy a 3-bedroom bungalow in Lugbe for ₦25M and rent it out for ₦2M per year. You continue renting a 2-bedroom flat in Wuse 2 for ₦5M per year. Your net annual housing cost is ₦3M (₦5M rent minus ₦2M income). Meanwhile, your Lugbe property appreciates at 12% annually, gaining roughly ₦3M in value per year. After five years, your property could be worth ₦44M while generating increasing rental income.

This strategy works especially well for younger professionals who need to live centrally for work but want to start building equity immediately. Learn more about this approach in our guide to property investment for beginners in Abuja.

Choosing the Right Investment Area

The key is selecting an area with strong rental demand and high appreciation potential. Look for areas with improving infrastructure, new road networks, and growing populations. The satellite towns around Abuja’s city centre have consistently delivered the best combination of affordability, rental demand, and capital growth.

Best Areas to Buy vs Rent in Abuja

Not all areas are equal when it comes to the rent-versus-buy decision. Some areas are clearly better for buying, others for renting, and some work well either way. Here is how Abuja’s major areas break down.

Best Areas to Buy (High Growth, Affordable Entry)

- Dawaki: One of Abuja’s fastest-growing areas with prices still below ₦40M for many properties. New estates and infrastructure projects are driving rapid appreciation.

- Lugbe: Abuja’s most popular affordable area with strong rental demand. Entry prices from ₦15M make it accessible for first-time buyers.

- Lokogoma: Increasingly popular with families, offering newer developments at mid-range prices with strong growth trajectory.

- Kubwa: Well-established satellite town with consistent demand and prices that continue to climb steadily.

Best Areas to Rent (Premium Living, High Purchase Costs)

- Maitama: Abuja’s most prestigious address. Buying costs start at ₦150M+, but you can rent a quality flat for ₦6M – ₦10M per year.

- Asokoro: Similar premium pricing makes renting the practical choice unless you have substantial capital.

- Wuse 2: Abuja’s commercial and lifestyle hub. Renting gives you access to its energy without the ₦100M+ purchase price.

Balanced Areas (Good for Either)

- Gwarinpa: Africa’s largest housing estate offers reasonable prices (₦45M – ₦90M) and strong rental demand. Buying and renting are both viable.

- Jahi: Mid-range prices with excellent location near the city centre. A good area to transition from renting to owning.

- Life Camp: Popular with families and professionals. Prices are mid-range and rental yields are healthy.

For a more in-depth look at Abuja’s top neighbourhoods for property buyers, see our guide to the best areas to buy a house in Abuja.

Making Your Decision: A Practical Framework

Still unsure? Run through this quick decision framework:

- Calculate your 5-year rent total. Add up what you will pay in rent over the next five years, including annual increases of 10-15%. This number is often shocking.

- Compare it to a purchase price. Find properties in areas you would consider living in (they do not have to be the same area you currently rent). If your 5-year rent total approaches or exceeds the purchase price of a decent property, buying is almost certainly better.

- Assess your stability. Will you be in Abuja for five or more years? If yes, lean towards buying. If no, lean towards renting.

- Check your capital. Can you afford the purchase price plus 20% for additional costs without putting yourself in financial distress? If yes, buy. If not, rent while saving aggressively.

- Consider the hybrid approach. If you cannot afford to buy where you want to live, can you buy an investment property elsewhere and rent where you are?

The most expensive decision is doing nothing. Whether you choose to rent strategically or buy wisely, make an active, informed choice rather than defaulting to the status quo year after year.

Frequently Asked Questions

Is it cheaper to rent or buy a house in Abuja?

In the short term (one to three years), renting is typically cheaper because buying involves significant upfront costs including legal fees, agency fees, and documentation that add 15-25% to the purchase price. However, over the long term (five years or more), buying is almost always cheaper. A tenant paying ₦3M per year in rent will spend over ₦48M in 10 years with no asset to show for it, while a buyer spending ₦40M on a property will likely own an asset worth ₦65M or more after the same period. The break-even point in Abuja is typically around four to six years, after which buying becomes increasingly advantageous.

How much rent do you pay per year in Abuja?

Annual rent in Abuja varies significantly by area and property type. For a 2-bedroom flat, expect to pay ₦1.5M – ₦3M in affordable areas like Lugbe and Kubwa, ₦2.5M – ₦4.5M in mid-range areas like Gwarinpa and Jahi, and ₦4M – ₦8M in prime areas like Maitama and Wuse 2. For 3-bedroom houses, prices range from ₦3M – ₦6M in affordable areas up to ₦8M – ₦15M in premium neighbourhoods. Most landlords require one to two years of rent paid upfront, plus agency and legal fees that can add another 30-50% to your first-year cost.

Can I get a mortgage to buy a house in Abuja?

Yes, but mortgage options in Nigeria remain limited and expensive. Commercial bank mortgages carry interest rates of 18-25% per annum with tenures of 10-20 years, making monthly payments very high. The National Housing Fund (NHF) offers a more affordable 6% rate, but the maximum loan of ₦15M is insufficient for most Abuja properties. Federal Mortgage Bank of Nigeria (FMBN) loans go up to ₦50M but involve lengthy processing times. Many buyers instead use developer payment plans that allow you to spread payments over 6-24 months, often with little or no interest. For a detailed look at your options, read our guide to understanding mortgage options in Nigeria.

What is the average house price in Abuja?

The average house price in Abuja depends heavily on the area. In affordable satellite towns like Lugbe and Kubwa, 3-bedroom houses start from ₦15M – ₦40M. Mid-range areas such as Gwarinpa, Jahi, and Life Camp see prices of ₦40M – ₦100M. Premium areas like Maitama and Asokoro command ₦100M – ₦500M+. Across the broader FCT, the median asking price for a standard 3-bedroom house is approximately ₦35M – ₦55M. For a full area-by-area breakdown, visit our guide on how much a house costs in Abuja.

Is Abuja property a good investment?

Abuja property has historically been one of Nigeria’s most reliable investments. Properties in developing areas have appreciated at 8-15% annually, outpacing inflation in most years. Rental yields in Abuja typically range from 5-10% per year, meaning your property generates income while simultaneously growing in value. As Nigeria’s capital and political centre, Abuja benefits from continuous government spending on infrastructure and a steady influx of professionals, diplomats, and civil servants who drive demand. The main risks include title documentation issues, market slowdowns tied to economic conditions, and the illiquidity of real estate compared to other investments.

How many years of rent equals buying a house in Abuja?

The break-even calculation depends on your area and property type, but here is a common example. If you rent a 3-bedroom flat in Gwarinpa for ₦4M per year (increasing 10% annually), you will pay approximately ₦25M in total rent over 5 years and ₦64M over 10 years. A comparable property to buy in Gwarinpa costs around ₦55M – ₦70M. This means you reach the break-even point in roughly 8-10 years for that area. In affordable areas like Lugbe, where a ₦25M house rents for ₦2M per year, the break-even is much faster at around 5-7 years. Factor in property appreciation, and the break-even comes even sooner.

What are the hidden costs of buying a house in Abuja?

Beyond the purchase price, expect to pay: legal fees of 5-10% for title verification, deed of assignment preparation, and registration; agency commission of 5% of the purchase price; Governor’s Consent fee of 3-6% for formal transfer of the Certificate of Occupancy; survey fees of ₦200,000 – ₦500,000; stamp duty; and potentially ₦2M – ₦10M in renovation costs depending on the property’s condition. All together, these hidden costs typically add 15-25% on top of the purchase price. A ₦40M property could cost you ₦48M – ₦50M by the time you move in. Always budget for these extras when planning your purchase.

Should I rent or buy if I am new to Abuja?

If you are new to Abuja, renting first is almost always the right move. Spend at least one to two years renting in or near the area where you work. During this time, explore different neighbourhoods on weekends, experience the traffic patterns during rush hours, visit areas during both the dry and rainy seasons, and talk to residents about their experiences. Abuja’s areas vary enormously in terms of lifestyle, commute times, flooding risk, and community feel. What looks perfect on paper may not suit your daily life. Use your rental period as research time, then make an informed purchase decision. Browse our area guides to start your research before you arrive.

Join The Discussion