Abuja is not just Nigeria’s capital — it is the country’s most stable and rewarding real estate market. While Lagos battles flooding, traffic gridlock, and speculative bubbles, Abuja offers something increasingly rare in Nigerian investment: predictability. Government spending flows consistently, diplomats and federal workers need housing year-round, and the city’s master plan ensures structured growth rather than chaotic sprawl.

Whether you are a first-time investor looking to park ₦15M–₦30M in a rental property, or a seasoned player eyeing land banks on the city’s expanding fringes, this Abuja property investment guide breaks down exactly where to put your money, what returns to expect, and how to avoid the pitfalls that trap unprepared buyers.

We cover the six main investment strategies, the best areas for returns in 2026, a worked ROI calculation you can apply to any deal, and a step-by-step checklist for closing your first investment. Every recommendation is grounded in current market data from Abuja’s most active property corridors.

If you are new to Abuja real estate, start with our complete guide to buying a house in Abuja for the fundamentals, then return here for the investment-specific strategy.

- Why Invest in Abuja Real Estate in 2026

- Types of Property Investment in Abuja

- Best Areas for Property Investment in Abuja in 2026

- How to Calculate Property Investment Returns

- Risks of Property Investment in Abuja

- Beginner’s Checklist for Your First Abuja Property Investment

- Frequently Asked Questions

- Is Abuja real estate a good investment in 2026?

- How much do I need to start investing in Abuja property?

- What is the average rental yield in Abuja?

- Which area in Abuja has the highest property appreciation?

- Is it better to invest in land or houses in Abuja?

- How do I avoid property investment scams in Abuja?

- Can I invest in Abuja property from abroad?

- What type of property gives the best returns in Abuja?

- How long should I hold property in Abuja before selling?

- Ready to Find Your Property?

Why Invest in Abuja Real Estate in 2026

Several structural forces make Abuja property one of the strongest investment classes available to Nigerians — and to diaspora investors looking for naira-denominated assets with real backing.

Population Growth and Housing Deficit

Abuja is one of the fastest-growing cities in Africa, with an estimated population exceeding 4 million and growing at roughly 5–6% annually. The housing deficit across the FCT is estimated at 2–3 million units, a gap that widens every year. This imbalance between supply and demand is the single biggest driver of both rental prices and capital appreciation. As long as the deficit persists — and there is no realistic scenario where it closes within a decade — property values have a structural floor beneath them.

Government and Diplomatic Demand

Unlike any other Nigerian city, Abuja hosts federal ministries, agencies, foreign embassies, and international organisations. These institutions create constant demand for quality housing — from luxury villas in Maitama for ambassadors to three-bedroom flats in Wuse 2 for mid-level civil servants. This demand is recession-resistant because it is tied to government budgets and diplomatic necessity, not consumer sentiment.

Infrastructure Development

The FCT continues to expand its road network, with new arterial roads opening up previously inaccessible areas like Karmo, Dawaki, and parts of Lugbe. The Abuja Light Rail, while delayed, has already pushed up land values along its planned corridors. Every new road or interchange that gets completed unlocks value in surrounding plots. Investors who position themselves ahead of infrastructure enjoy the largest gains.

Property as an Inflation Hedge

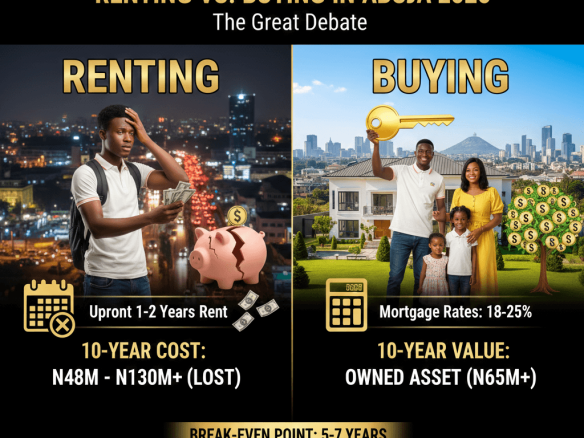

With the naira losing over 70% of its value against the dollar since 2020, Nigerians are learning a painful lesson: cash savings erode. Fixed deposits yield 10–15% but inflation runs at 25–30%, meaning you lose purchasing power every year. Stocks on the NGX are volatile and poorly regulated. Crypto is speculative. Property, by contrast, appreciates in nominal terms at or above inflation while generating rental income on top. A property bought for ₦30M in 2022 in a growth area like Dawaki could be worth ₦50M–₦60M today — a return no savings account can match.

How Property Compares to Other Nigerian Investments

- Fixed deposits: 10–15% nominal yield, negative real returns after inflation

- Nigerian stocks (NGX): Volatile, average 15–20% in good years, can lose 30%+ in bad years

- Crypto: Highest potential upside but extreme volatility and regulatory uncertainty

- Abuja property: 5–8% rental yield + 15–30% annual appreciation in growth areas = 20–38% total return with a tangible, insurable asset

For most Nigerians, property is the only investment that simultaneously generates income, appreciates faster than inflation, and can be passed down to the next generation. Explore current property prices in Abuja to see what different budgets can achieve.

Types of Property Investment in Abuja

Not all property investment is the same. Your strategy should match your budget, risk tolerance, and time horizon. Here are the five main approaches Abuja investors use.

Buy-to-Let (Rental Income)

The most straightforward strategy: buy a property and rent it out. Your return comes from annual rent payments, typically collected one to two years in advance in Abuja — a significant advantage over markets where rent is paid monthly.

Expected yields vary by location and property type. Residential properties in established areas like Wuse 2, Garki, and Maitama yield 5–8% annually. Commercial properties — shops, office spaces, warehouses — can yield 8–12% but require larger capital and carry higher vacancy risk.

Best areas for rental income include Wuse 2 (professionals and expatriates), Garki (civil servants), and Maitama (diplomatic tenants who pay premium rents). For steady, mid-range demand, Gwarinpa and Jahi offer reliable occupancy with less management hassle. Browse available houses for sale in Abuja to find rental-ready properties.

Buy-and-Hold (Capital Appreciation)

Buy in an emerging area, hold for 3–5 years, and sell at a significant markup. This strategy works best in areas where infrastructure is arriving, population is moving in, and developers are actively building.

Capital appreciation in Abuja’s hottest corridors runs at 15–30% per year. A plot bought in Dawaki for ₦8M in 2021 could sell for ₦18M–₦22M in 2026. The key is identifying areas before they peak — buying after an area is fully developed means you have missed the bulk of the appreciation.

Top buy-and-hold areas in 2026: Dawaki, Lugbe, Lokogoma, and Karmo. These areas are still developing but have enough infrastructure to attract buyers when you exit.

Off-Plan Investment

Developers sell units before or during construction at a 20–40% discount to the expected completed price. You pay in installments as the building progresses, then either move in, rent out, or sell at completion.

The upside is significant: you can acquire a ₦50M property for ₦30M–₦35M if you buy at foundation stage. The downside is equally real — developer default is common in Abuja. Projects stall, timelines slip by years, and some developers disappear entirely. Only invest off-plan with established developers who have a track record of completed projects, and ensure your contract includes penalty clauses for delays.

Land Banking

The lowest-cost entry into Abuja property investment. Buy land in Abuja in areas that are currently undeveloped but sit along growth corridors, then hold until the area develops and sell at a multiple of your purchase price.

Land on the outskirts of the FCT can be acquired for as little as ₦3M–₦8M per plot, compared to ₦50M–₦200M+ in established areas. The trade-off is time — you may need to hold for 5–10 years before meaningful appreciation kicks in. You also earn zero income while holding, so this strategy suits patient investors who do not need cash flow.

Short-Let / Airbnb

Furnished apartments rented out nightly, weekly, or monthly to business travellers, tourists, and relocating professionals. This is the highest-yield residential strategy in Abuja, with returns of 12–20% annually — but it is also the most management-intensive.

You need to furnish the property (budget ₦3M–₦8M for quality furnishing), handle cleaning, guest communication, maintenance, and marketing. Best locations are Wuse 2, Maitama, and Jabi — areas with high foot traffic from visitors who prefer serviced apartments over hotels. If you are not based in Abuja, you will need a reliable property manager, which eats into your margins.

Best Areas for Property Investment in Abuja in 2026

Not every area in Abuja delivers the same returns. Here are the six strongest investment corridors right now, with specific data on what to expect. For a broader overview of all Abuja neighbourhoods, see our guide to the best areas to buy a house in Abuja.

Dawaki — Best for Capital Appreciation

Dawaki is Abuja’s fastest-appreciating residential area. Sitting just north of Gwarinpa with expanding road access, prices here have climbed 20–25% annually over the past three years. A 3-bedroom semi-detached house starts from ₦25M, and new estates are being completed every quarter.

Why invest: proximity to Gwarinpa’s amenities, rapidly improving infrastructure, and a large young-family demographic driving demand. The area is still in its growth phase, meaning there is room for further appreciation before it plateaus.

View properties for sale in Dawaki

Lugbe — Best for Buy-to-Let + Appreciation

Lugbe benefits from its position near the Nnamdi Azikiwe International Airport and along the Airport Road corridor. Properties here are affordable — houses start from ₦15M — and rental demand is strong from airport workers, airline staff, and commuters who work in the city centre.

Why invest: dual returns from both rent and appreciation. Lugbe is transitioning from a budget area to a mid-market one, which means current buyers get in at the lower end of a rising price curve. Rental yields run at 6–8%, and appreciation has been 15–20% annually.

View properties for sale in Lugbe

Wuse 2 — Best for Rental Income

Wuse 2 is Abuja’s commercial and social hub. Demand for rental property here is relentless — 2-bedroom flats rent for ₦3M–₦5M per year, and 3-bedroom flats command ₦4M–₦8M. Tenants are professionals, expatriates, and business owners who value proximity to offices, restaurants, and nightlife.

Why invest: near-zero vacancy rates in quality properties and the highest absolute rents in the city. The downside is the high entry cost — expect to pay ₦60M–₦120M for a well-located flat. But the rental income is proportionally high, and the area’s status as a prime location makes resale straightforward.

View properties for sale in Wuse 2

Jahi — Best for Balanced Returns

Jahi offers a rare combination: modern, well-planned estates with solid infrastructure, good rental demand, and ongoing appreciation. Located near Jabi and Gwarinpa, it attracts families and professionals who want quality housing without the premium of Maitama or Asokoro.

Houses in Jahi start from ₦50M, with rental yields of 5–7% and appreciation running at 12–18% annually. The area is well-suited to investors who want steady, predictable returns without the volatility of emerging areas.

View properties for sale in Jahi

Life Camp — Best for Growing Demand

Life Camp has evolved from a quiet residential area into a bustling neighbourhood with shopping centres, schools, and improved road access. Its proximity to Jabi Lake and the Jabi axis makes it attractive to young professionals and families.

Properties start from ₦40M, and the area has seen consistent appreciation of 12–15% per year. Rental demand is solid, particularly for 3-bedroom and 4-bedroom houses in gated estates. As Jabi and Utako become saturated, overflow demand pushes tenants and buyers toward Life Camp.

View properties for sale in Life Camp

Lokogoma — Best Emerging Area

Lokogoma is one of Abuja’s quietest residential districts — and one of its most undervalued. Prices start from ₦20M for decent houses, which is well below comparable areas like Jahi or Life Camp. The area is still developing its commercial infrastructure, which keeps prices low but also means significant upside as amenities arrive.

Why invest: low entry cost, growing population, and the kind of peaceful residential character that Abuja’s middle class increasingly wants. Appreciation has been running at 15–20% annually, and we expect this to continue as the area fills in.

View properties for sale in Lokogoma

For a complete breakdown of Abuja’s neighbourhoods with pricing and character descriptions, visit our Abuja area guide.

How to Calculate Property Investment Returns

Too many investors in Abuja buy based on gut feeling. Here is how to calculate your actual returns so you can compare properties objectively and make data-driven decisions.

Rental Yield

This tells you what percentage of the property’s value you earn back in rent each year.

Rental Yield = (Annual Rent / Property Purchase Price) x 100

Example: You buy a flat in Wuse 2 for ₦80M and rent it out for ₦5M per year. Your rental yield is (5,000,000 / 80,000,000) x 100 = 6.25%.

Capital Appreciation

This measures how much the property’s value has increased over your holding period.

Capital Appreciation = (Current Value – Purchase Price) / Purchase Price x 100

Example: You bought a house in Dawaki for ₦30M two years ago. It is now worth ₦38M. Your capital appreciation is (38,000,000 – 30,000,000) / 30,000,000 x 100 = 26.7% over two years, or roughly 13.3% per year.

Total ROI — A Worked Example

Let us combine everything with a realistic Dawaki scenario:

- Purchase price: ₦30M

- Annual rent collected: ₦2.5M (yield: 8.3%)

- Property value after 2 years: ₦38M (appreciation: 26.7%)

- Total rental income over 2 years: ₦5M

- Costs over 2 years (legal fees, agency fees, maintenance, taxes): approximately ₦2M

Total ROI = (Rental Income + Capital Gain – Costs) / Purchase Price x 100

Total ROI = (₦5M + ₦8M – ₦2M) / ₦30M x 100 = 36.7% over 2 years

That is an annualised return of approximately 18.3% — comfortably ahead of inflation and far above fixed deposit rates. This is why informed investors continue to favour Abuja property. To understand the price landscape better, read our breakdown of how much a house costs in Abuja.

Risks of Property Investment in Abuja

Every investment carries risk. Here are the main threats to your capital in Abuja real estate and how to mitigate each one.

Title Fraud and Land Scams

This is the single biggest risk in Nigerian real estate. Fraudsters sell properties they do not own, forge C of Os, or sell the same plot to multiple buyers. Mitigation: always conduct a thorough land search at the Abuja Geographic Information Systems (AGIS) office, verify the seller’s identity, and engage a qualified property lawyer before paying. Read our detailed guide on conducting land searches and verifying property titles in Abuja.

Regulatory Changes and Land Revocations

The FCT Administration can revoke land allocations for non-development or public interest. Properties built on land without proper approval can be demolished. Mitigation: only buy properties with valid titles (C of O, R of O, or approved building plans) and ensure the seller has developed the land within the stipulated timeframe.

Illiquidity

Property is not a liquid asset. Selling a house in Abuja can take 3–12 months, and you may need to accept a discount for a quick sale. Mitigation: do not invest money you might need urgently. Maintain a separate emergency fund in liquid assets. Buy in areas with high transaction volume — Wuse 2 and Gwarinpa sell faster than remote locations.

Developer Default on Off-Plan Projects

Developers may run out of funds, divert money to other projects, or simply disappear. Mitigation: only invest off-plan with developers who have completed at least two previous projects that you can physically inspect. Pay in milestones tied to construction progress, never the full amount upfront.

Tenant Issues

Non-payment of rent, property damage, and refusal to vacate are common challenges. Mitigation: screen tenants carefully, collect one to two years’ rent in advance (standard in Abuja), include clear penalty clauses in your tenancy agreement, and use a reputable property management company.

Market Correction

While unlikely in Abuja given the persistent housing deficit, localised price corrections can occur in areas that were speculatively overpriced. Mitigation: buy based on fundamentals (infrastructure, demand drivers, comparable transactions) rather than hype. Avoid paying above-market prices during bidding wars.

For more investment safety tips, read our top tips for property investment in Abuja.

Beginner’s Checklist for Your First Abuja Property Investment

If this is your first time investing in Abuja property, follow this step-by-step checklist to protect your capital and maximise your returns.

- Define your investment goal. Are you investing for rental income, capital appreciation, or both? Your goal determines the type of property and area you should target.

- Set a realistic budget. Include not just the purchase price but also legal fees (typically 5–10% of the property value), agency commission (5%), and furnishing costs if applicable. See affordable housing options for investment in Abuja.

- Choose your target area. Match the area to your strategy — growth areas for appreciation, established areas for rental income. Use our Abuja area guide for detailed neighbourhood profiles.

- Engage a qualified property lawyer. Do this before you start viewing properties. Your lawyer should be experienced in FCT property transactions and independent of the seller or agent.

- Verify all documents. Confirm the C of O, survey plan, and building approval with AGIS. Check for encumbrances, pending litigation, or revocation notices. Never skip this step.

- Physically inspect the property. Visit the site, check the neighbourhood, talk to neighbours, and inspect the building quality. If buying off-plan, visit the developer’s previously completed projects.

- Negotiate the price. Almost every property price in Abuja is negotiable. Start at 10–15% below the asking price. Use comparable sales data to support your offer.

- Close the deal properly. Ensure the deed of assignment is signed, stamped, and registered. Pay through traceable channels (bank transfer, not cash). Collect all original documents.

For a comprehensive walkthrough of the entire buying process, read our complete guide to buying a house in Abuja. If you are completely new to property investment, our beginner’s guide to property investment in Abuja covers the fundamentals.

Frequently Asked Questions

Is Abuja real estate a good investment in 2026?

Yes. Abuja remains one of the strongest property markets in Nigeria. Average capital appreciation in growth areas runs at 15–25% annually, while rental yields range from 5–8% for residential and 8–12% for commercial properties. Combined with the persistent housing deficit of 2–3 million units and steady government-driven demand, the fundamentals strongly favour property investment in the FCT. The key is choosing the right area and investment strategy to match your goals.

How much do I need to start investing in Abuja property?

The entry point depends on your chosen strategy. Land banking is the most accessible, with plots in developing areas starting from ₦3M–₦5M. Completed houses in affordable areas like Lugbe start from ₦15M, while mid-range areas like Dawaki and Lokogoma start from ₦20M–₦25M. Budget an additional 10–15% for legal fees, agency commission, and transaction costs. For a full price breakdown, see our guide on how much a house costs in Abuja.

What is the average rental yield in Abuja?

Average residential rental yield in Abuja ranges from 5% to 8%, depending on the area and property type. Prime areas like Wuse 2, Maitama, and Asokoro sit at the higher end due to premium rents from expatriates and senior professionals. Commercial properties — offices, shops, and warehouses — yield 8–12% but require larger capital outlays. Short-let apartments in prime locations can achieve 12–20% yields but demand active management.

Which area in Abuja has the highest property appreciation?

Dawaki currently leads with appreciation rates of 20–25% per year, driven by its proximity to Gwarinpa and rapid infrastructure development. Lugbe follows closely at 15–20%, benefiting from airport proximity and improving road access. Other emerging areas with strong appreciation include Lokogoma, Karmo, and parts of Kubwa. Established areas like Maitama and Asokoro appreciate more slowly (5–10%) but carry lower risk.

Is it better to invest in land or houses in Abuja?

Land offers higher long-term appreciation and lower entry costs but generates zero income while you hold it. Houses generate rental income immediately but cost more upfront and come with maintenance responsibilities. The best approach for most investors is a balanced strategy: buy rental property for cash flow and land in emerging areas for appreciation. Browse available land for sale in Abuja and houses for sale in Abuja to compare options.

How do I avoid property investment scams in Abuja?

The three non-negotiable steps are: (1) conduct a land search at AGIS to verify the title, (2) engage an independent property lawyer before making any payment, and (3) never pay cash — always use bank transfers for a traceable record. Additionally, be wary of prices significantly below market value, pressure to pay quickly, and sellers who cannot produce original documents. Our detailed guide on verifying property titles in Abuja walks you through the entire verification process.

Can I invest in Abuja property from abroad?

Yes. Many diaspora Nigerians successfully invest in Abuja real estate. The key requirements are: a trusted property lawyer in Abuja to handle due diligence and closing, a reliable property management company for ongoing management, and a Nigerian bank account for transactions. Power of Attorney can be granted to your lawyer for document signing. Start by researching areas and prices online, then engage professionals on the ground before committing funds. Our guide on moving to Abuja from abroad covers practical relocation and investment considerations.

What type of property gives the best returns in Abuja?

Short-let apartments deliver the highest rental yields at 12–20%, but they require active management and higher upfront costs for furnishing. Land in emerging areas offers the best capital appreciation at 20–30% annually but provides no income. For a balanced return, buy-to-let houses in mid-range growth areas like Dawaki or Lugbe offer 6–8% rental yield plus 15–20% appreciation, giving a total annual return of 21–28% with manageable effort.

How long should I hold property in Abuja before selling?

The minimum recommended holding period is 3–5 years. In the first two years, transaction costs (legal fees, agency commissions, capital gains tax) can eat into your returns, even if the property has appreciated. After 3 years, appreciation typically outpaces these costs comfortably. For land banking, plan to hold for 5–10 years for maximum returns. If you are generating strong rental income, there may be no reason to sell at all — let the property continue earning while appreciating in value.

Join The Discussion