Buying your first home in Abuja is one of the most exciting decisions you will ever make. After years of paying rent, building someone else’s equity, and dealing with unpredictable landlords, you are finally ready to own your own space. But if we are being honest, the process can feel overwhelming.

The Abuja property market works differently from what you might expect. Prices vary wildly from one area to the next, the documentation process has pitfalls that catch even experienced buyers, and the total cost of buying a house is always higher than the listed price. First-timers who go in without preparation often end up overpaying, buying into problematic properties, or worse — falling victim to fraud.

But here is the good news: thousands of people buy their first home in Abuja every year, and you can too. You just need the right information, a clear plan, and a healthy dose of patience. Whether you are a young professional earning your first real income, a growing family that has outgrown your rented flat, or a diaspora Nigerian looking to plant roots back home, this guide covers everything.

We will walk you through realistic budgets, a step-by-step buying process, financing options, the best areas for first-time buyers, and the most common mistakes to avoid. By the end, you will have a clear roadmap from “I want to buy a house” to holding your keys. For a broader overview of the entire process, you can also read our complete guide to buying a house in Abuja.

- How Much Do You Need to Buy Your First Home in Abuja?

- Step-by-Step Guide to Buying Your First Home in Abuja

- Step 1: Define Your Needs

- Step 2: Get Your Finances Ready

- Step 3: Choose the Right Area

- Step 4: Start House Hunting

- Step 5: Inspect the Property Thoroughly

- Step 6: Verify Ownership Documents

- Step 7: Engage a Property Lawyer

- Step 8: Negotiate the Price

- Step 9: Make Payment and Sign Documents

- Step 10: Take Possession

- Financing Options for First-Time Buyers in Abuja

- Best Areas for First-Time Buyers in Abuja

- 10 Mistakes First-Time Home Buyers Make in Abuja

- Ready to Buy Your First Home in Abuja?

- Frequently Asked Questions

- How much does a first-time buyer need to buy a house in Abuja?

- What documents do I need to buy a house in Abuja?

- Can I buy a house in Abuja with a salary of ₦500,000 per month?

- What is the cheapest area to buy a house in Abuja?

- Do I need a lawyer to buy property in Abuja?

- How long does it take to buy a house in Abuja?

- Is it better to buy a new house or an existing one in Abuja?

- What is the National Housing Fund and how does it help first-time buyers?

- Can I buy a house in Abuja without a C of O?

- What should I inspect before buying a house in Abuja?

- Continue Reading

How Much Do You Need to Buy Your First Home in Abuja?

This is the first question every first-time buyer asks, and the answer depends entirely on where you want to live and what kind of property you are looking for. Abuja has options for almost every budget, but you need to be realistic about what your money can get you.

Realistic Budget Breakdown by Area

Entry-level areas (Kubwa, Lugbe, Kuje, Karmo): You can find 2-3 bedroom bungalows and semi-detached houses starting from ₦12M to ₦30M. These areas are further from the city centre but offer the most affordable entry point into homeownership. Many new estates are springing up with modern finishes at competitive prices.

Mid-range areas (Gwarinpa, Jahi, Life Camp, Dawaki, Lokogoma): Expect to pay ₦30M to ₦80M for 3-4 bedroom houses in established estates. These areas have better infrastructure, more amenities, and stronger community facilities. This is where most first-time buyers with steady professional incomes end up.

Premium areas (Maitama, Asokoro, Wuse 2, Katampe Extension): Prices range from ₦80M to ₦300M and above. Unless you have significant savings or high income, these areas are typically out of reach for most first-time buyers. For a detailed price analysis across all areas, see our guide on how much a house costs in Abuja.

Beyond the Purchase Price — Additional Costs

Here is what catches most first-time buyers off guard: the listed price is not the final price. You need to budget for several additional costs:

- Legal fees: 5-10% of the property value. This covers your lawyer’s fees for due diligence, document verification, and drafting the deed of assignment.

- Agency commission: Typically 5% of the property price. This is usually paid by the seller, but in practice it is often negotiable and sometimes split.

- Survey and documentation: ₦200,000 to ₦500,000 for survey plans, consent fees, and government charges.

- Renovation and finishing: ₦2M to ₦10M depending on the state of the property. Even “new” houses in Abuja often need some finishing work — tiling, painting, plumbing fixes, or kitchen fitting.

- Moving costs, furniture, and security installations: ₦500,000 to ₦3M depending on your needs. Security doors, CCTV, fencing repairs, and basic furnishing add up fast.

Rule of thumb: budget 15-20% above the listed price to cover total costs. If a house is listed at ₦40M, plan for ₦46M to ₦48M in total spending. Going in with this mindset prevents the financial shock that derails many first-time purchases.

Step-by-Step Guide to Buying Your First Home in Abuja

The buying process in Abuja follows a fairly predictable path once you know what to expect. Here are the ten steps that will take you from browsing to owning.

Step 1: Define Your Needs

Before you look at a single listing, sit down and answer some key questions. How many bedrooms do you need? A young couple might be fine with 2 bedrooms, but if you are planning for children, think 3-4 bedrooms. Do you prefer an estate or a standalone property? Estates offer shared security, maintained roads, and a sense of community but come with service charges. Standalone properties give you more freedom but require you to handle everything yourself.

Think about proximity to your workplace, your children’s school, hospitals, and markets. In Abuja, commute time can make or break your quality of life. A beautiful house in Kuje means very little if you spend three hours daily in traffic to get to Wuse.

Step 2: Get Your Finances Ready

Most property transactions in Abuja are cash-based, which means you need to have your funds available before you start seriously shopping. Assess your total available resources: personal savings, salary income, NHF contributions, family support, and any payment plan options.

If you are a salaried employee contributing to the National Housing Fund (NHF), check your balance — you may have accumulated a significant amount. If you belong to a cooperative society, find out what housing loans they offer. Many developers now offer payment plans that let you spread payments over 6 to 24 months, which can make a huge difference for first-time buyers.

Step 3: Choose the Right Area

Location is the single most important decision in real estate. Consider these factors: commute time to work, availability of water and electricity, road quality, security of the neighbourhood, and future development plans.

An area with ongoing infrastructure development (like new roads or shopping centres being built) often means property values will appreciate. We have a detailed breakdown of the best areas to buy a house in Abuja that covers every major neighbourhood. You can also explore our area guides for in-depth information on specific locations.

Step 4: Start House Hunting

Now comes the exciting part. Browse listings on airealent.ng to get a feel for what is available in your budget and preferred areas. Save properties that interest you, compare prices, and start scheduling physical visits.

Work with a reputable agent who knows the area well. A good agent will show you properties that match your criteria, give you honest assessments, and help with negotiations. Visit at least 5-10 properties before making a decision — this gives you enough context to know a good deal when you see one.

Step 5: Inspect the Property Thoroughly

Never buy a house based on pictures alone — always do a physical inspection, and ideally bring someone with construction experience. Check the roof for leaks or sagging, test the plumbing by running taps and flushing toilets, and inspect the electrical wiring. Look for cracks in walls (especially diagonal cracks, which can indicate foundation problems), check the drainage around the property, and assess the fencing and gates.

Visit the property at different times of day. A neighbourhood that seems quiet at noon might be noisy at night. Check if the road floods during rain — ask the neighbours, they will tell you the truth.

Step 6: Verify Ownership Documents

This step is non-negotiable. Before you pay a single naira, verify that the seller actually owns the property and has the right to sell it. The key documents to check include:

- Certificate of Occupancy (C of O): The gold standard of land ownership in Abuja, issued by FCTA.

- Survey plan: Confirms the exact boundaries and size of the property.

- Deed of assignment: Shows the chain of ownership if the property has changed hands before.

- Building approval: Confirms the structure was built with government approval.

For a comprehensive guide on verifying property titles, read our article on conducting land search and verifying property titles in Abuja. You should also understand the different types of land title documents in Abuja.

Step 7: Engage a Property Lawyer

Do not skip this step. A property lawyer is your most important protection against fraud, forged documents, and legal complications down the road. Your lawyer will conduct an independent search at the land registry, verify the authenticity of all documents, draft or review the deed of assignment, and ensure the transaction complies with all legal requirements.

Expect to pay 5-10% of the property value for legal services. Yes, it adds to your costs. But consider this: losing ₦40M to a fraudulent transaction because you wanted to save ₦2M on legal fees is not a trade-off any sane person would make.

Step 8: Negotiate the Price

Almost every listed price in the Abuja market is negotiable. The key is to negotiate from a position of knowledge. Know the going rate for similar properties in the area, understand how long the property has been on the market (longer means more room to negotiate), and be prepared to walk away if the price does not work for you.

A reasonable starting offer is 10-15% below the asking price. Be respectful but firm. If the seller is motivated (relocating, needs quick cash, or has had the property listed for months), you have more leverage. Never reveal your maximum budget — let the negotiation find its natural level.

Step 9: Make Payment and Sign Documents

Once you agree on a price, your lawyer will prepare the deed of assignment. Payment should be structured carefully: typically a deposit (10-30%) to show commitment, with the balance paid upon signing the deed of assignment and receiving the original documents.

Always pay through traceable channels — bank transfers, not cash. Get official receipts for every payment. The deed of assignment should be signed by both parties in the presence of witnesses and a commissioner for oaths. Your lawyer will handle the perfection of the title (government consent and registration).

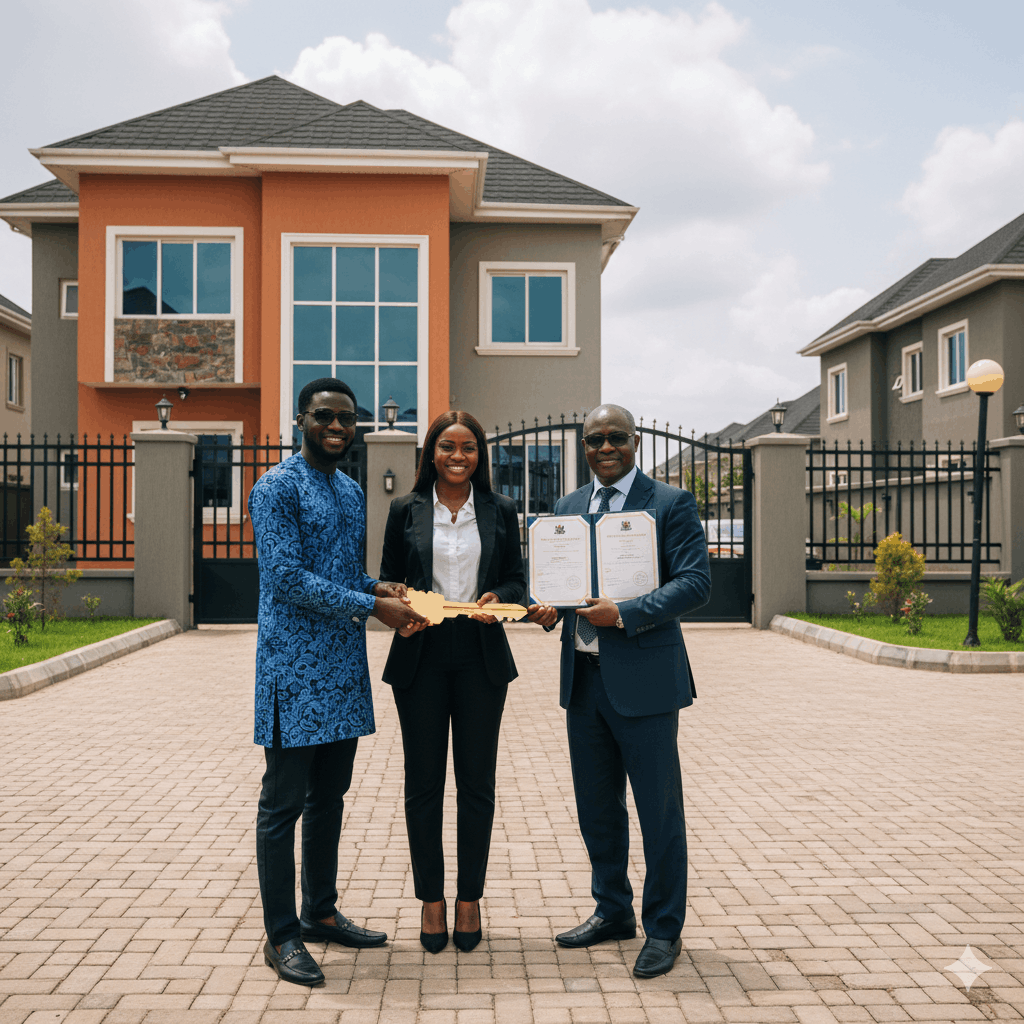

Step 10: Take Possession

Before you collect the keys, do a final inspection to make sure the property is in the agreed condition. Check that no fixtures have been removed, all agreed repairs have been done, and the property is vacant. Collect all keys, gate remotes, and access codes.

Transfer utilities (electricity, water) into your name. Introduce yourself to the estate management (if applicable) and your neighbours. Congratulations — you are officially a homeowner in Abuja.

Financing Options for First-Time Buyers in Abuja

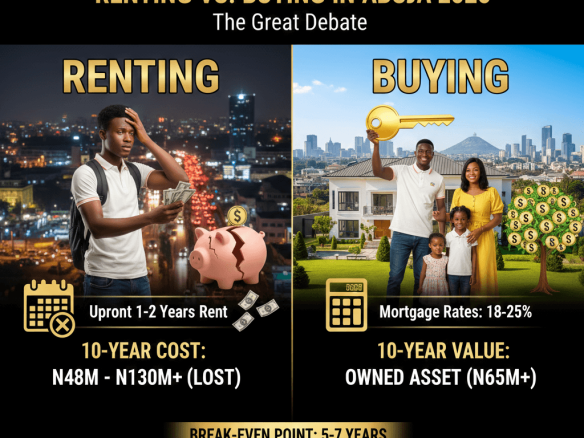

Buying a house with cash is ideal, but it is not the only way. Several financing options exist for first-time buyers in Nigeria, though each comes with its own requirements and limitations. For a detailed breakdown, read our guide on understanding mortgage options in Nigeria.

National Housing Fund (NHF)

The NHF is arguably the best financing option for salaried first-time buyers. If you have been contributing 2.5% of your monthly salary to the NHF, you can access a mortgage of up to ₦15 million at just 6% interest per annum — far below commercial rates. The repayment period can stretch up to 30 years, making monthly payments very manageable. The catch? The ₦15M cap means it works best for properties in affordable areas like Kubwa, Lugbe, or Kuje.

Federal Mortgage Bank of Nigeria (FMBN)

The FMBN operates through Primary Mortgage Banks (PMBs) across the country. They offer various mortgage products with interest rates typically between 6% and 9%. The application process can be lengthy, but the rates are significantly better than commercial banks. Visit an FMBN-accredited PMB to explore your options.

Commercial Bank Mortgages

Major banks like Access, GTBank, and Stanbic IBTC offer mortgage products, but be prepared for higher interest rates — typically 18% to 25% per annum. The advantage is that they can lend larger amounts and the process can be faster. You will need a stable income, good credit history, and usually a 20-30% down payment. These mortgages work best for higher-value properties where NHF limits are insufficient.

Developer Payment Plans

Many developers in Abuja now offer payment plans that let you pay 30-60% upfront and spread the balance over 6 to 24 months. This is not a mortgage — there is typically no interest, but there may be a price premium built in. It is a popular option for first-time buyers who have steady income but have not saved the full amount. Just make sure you are dealing with a reputable developer with a track record of delivery.

Cooperative Societies

If you belong to a workplace or community cooperative, this can be a powerful tool. Many cooperatives offer housing loans at rates between 5% and 12%, with repayment deducted directly from your salary. Some cooperatives even negotiate bulk purchases from developers, getting members better prices. If you do not belong to a cooperative, joining one is worth considering as a long-term strategy.

Family Pooling

Let us be honest — family pooling is how many Nigerians buy their first home. Siblings, parents, and extended family contributing towards a property purchase is culturally accepted and practically effective. The key is to be transparent about the arrangement, document everyone’s contributions in writing, and clarify ownership upfront to avoid disputes later.

Best Areas for First-Time Buyers in Abuja

Not every area in Abuja is suitable for a first-time buyer. You want a combination of affordable prices, decent infrastructure, safety, and potential for appreciation. Here are our top recommendations based on buyer type.

Best for Young Professionals

Dawaki: One of the fastest-growing areas in Abuja, with modern estates, good road networks, and proximity to Gwarinpa. 3-bedroom houses start from ₦25M to ₦40M. It is young, vibrant, and increasingly well-connected.

Jahi: Close to the Jabi area with its malls and offices. Expect to pay ₦35M to ₦60M for a decent 3-bedroom house. Great for professionals working in the Wuse-Jabi corridor.

Kubwa: The most affordable option close to the city. You can find solid 3-bedroom houses from ₦15M to ₦30M. The trade-off is a longer commute, but the Airport Road expansion is improving access significantly.

Best for Families

Gwarinpa: Abuja’s largest housing estate, with established schools, hospitals, markets, and a strong community feel. Prices range from ₦40M to ₦80M for 3-4 bedroom houses. It is the go-to area for families who want everything within reach.

Life Camp: Excellent infrastructure, proximity to good schools, and a family-friendly environment. Expect ₦35M to ₦70M. It neighbours Gwarinpa and shares many of the same advantages.

Lokogoma: A quieter, more spacious alternative with newer estates and larger plots. Prices start from ₦30M for 3-bedroom houses. Ideal for families who prefer a less congested environment.

Best for Budget Buyers

Lugbe: Arguably the most popular area for first-time buyers on a tight budget. 2-3 bedroom houses start from ₦12M to ₦25M. Infrastructure is improving steadily, and the area has good access to the airport and city centre.

Kuje: Even more affordable, with houses from ₦10M to ₦20M. It is further out, but for buyers who prioritize ownership over location, Kuje offers the lowest barrier to entry.

Karmo: Sitting between Life Camp and Kubwa, Karmo offers surprising value at ₦15M to ₦30M for areas that are still relatively close to central Abuja.

Best for Future Appreciation

Dawaki, Lugbe, and Dutse are the areas where property values are rising fastest. Buying in these locations today means your property could be worth 30-50% more in 3-5 years as infrastructure catches up with development. If you are thinking long-term, these areas offer the best combination of affordability and growth potential.

For a deeper analysis of every area, check our guide to the best areas to buy a house in Abuja, or browse houses for sale across Abuja to see current prices.

10 Mistakes First-Time Home Buyers Make in Abuja

Learning from other people’s mistakes is cheaper than making your own. Here are the ten most common errors we see first-time buyers make in Abuja.

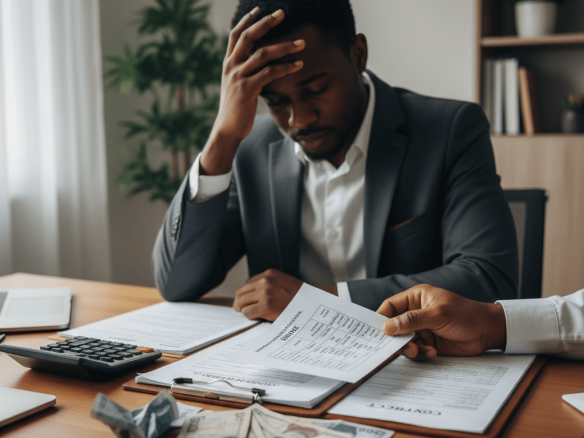

1. Buying without a lawyer. This is the single biggest mistake. Some buyers try to save money by handling the legal side themselves, only to discover months later that the documents are forged or the seller had no right to sell. A property lawyer costs far less than a lost investment.

2. Not verifying the Certificate of Occupancy (C of O). A C of O can be faked. Your lawyer should conduct an independent search at the Abuja Geographic Information Systems (AGIS) to confirm the document is genuine and that the property is not under any encumbrance or dispute. Learn more about land title documents in Abuja.

3. Ignoring infrastructure. That ₦15M house looks like a steal until you realise there is no tarred road, no public water supply, and electricity is a distant dream. Always assess infrastructure before falling in love with a price tag. Visit the area, talk to residents, and check what services are actually available — not just promised.

4. Buying based on pictures alone. Photos can be misleading. Wide-angle lenses make rooms look bigger, photos may be from before damage occurred, and some listings use pictures of completely different properties. Always physically inspect any property before committing money.

5. Not budgeting for additional costs. As we covered earlier, the listed price is just the starting point. Legal fees, agency commission, renovation, documentation, and moving costs can add 15-20% to your total spend. First-timers who budget only for the purchase price often find themselves stuck midway through the process.

6. Rushing because of “price increase” pressure. “The price is going up next week” is the oldest trick in Abuja real estate. While prices do increase over time, genuine sellers do not pressure you with artificial deadlines. Take your time, do your due diligence, and never let urgency override caution.

7. Buying from unverified agents or developers. Not every agent or developer is legitimate. Check their track record, ask for references from previous buyers, visit properties they have delivered, and verify their business registration. If an agent cannot show you proof of previous successful transactions, walk away.

8. Not checking for structural defects. Cracks in walls, damp patches, sagging roofs, and poor drainage are expensive problems to fix. Bring a building professional for your inspection — they will spot issues that you might miss. The cost of a professional inspection (₦50,000-₦150,000) is negligible compared to the cost of major structural repairs.

9. Ignoring the neighbourhood. A beautiful house in a flood-prone area is a bad investment. A lovely estate next to a noisy market will affect your quality of life. Research the neighbourhood as carefully as you research the property itself. Check for flood history, noise levels, security incidents, and the general character of the area.

10. Not getting receipts and proper documentation. Every payment should be documented. Every agreement should be in writing. Verbal promises mean nothing in real estate. Insist on official receipts, signed agreements, and properly executed documents for every stage of the transaction. Your lawyer should keep copies of everything. You can also review our list of important questions to ask before buying property in Abuja.

Ready to Buy Your First Home in Abuja?

Buying your first home is a significant milestone, and doing it right requires preparation, patience, and the right guidance. The Abuja real estate market has genuine opportunities for first-time buyers at every budget level — from ₦12M starter homes in Lugbe to ₦60M family houses in Gwarinpa.

The key is to start with a clear budget, choose your area wisely, verify everything, and never skip the legal process. Take your time, ask questions, and do not be afraid to walk away from a deal that does not feel right. The right property will come.

Start your search today by browsing houses for sale in Abuja on airealent.ng. If you are also considering land for future development, explore available land in Abuja. And for those just starting their investment journey, our guide on property investment for beginners in Abuja is an excellent next read.

Frequently Asked Questions

How much does a first-time buyer need to buy a house in Abuja?

The minimum budget for a first-time buyer in Abuja starts from ₦12M to ₦15M in satellite towns like Kubwa, Lugbe, and Kuje for a basic 2-3 bedroom house. In more central areas like Gwarinpa, Jahi, and Life Camp, expect to pay ₦30M to ₦80M. Remember to add 15-20% to the listed price for legal fees, documentation, renovation, and other costs. For a full price breakdown by area, see our guide on how much a house costs in Abuja.

What documents do I need to buy a house in Abuja?

As a buyer, you will need a valid government-issued ID (national ID, international passport, or driver’s licence), tax clearance certificate, proof of income or source of funds (bank statements, employment letter), and evidence of address. For the property itself, ensure the seller provides the Certificate of Occupancy (C of O), survey plan, deed of assignment from the previous owner, and building approval. Your lawyer will guide you on any additional documents required for your specific transaction.

Can I buy a house in Abuja with a salary of ₦500,000 per month?

Yes, it is possible. With a monthly salary of ₦500,000, you can explore several paths: the National Housing Fund (NHF) offers up to ₦15M at 6% interest, which covers properties in Kubwa, Lugbe, or Kuje. Cooperative housing loans can supplement your savings. Many developers also offer payment plans where you pay 30-50% upfront and spread the balance over 12-24 months. With disciplined saving and the right financing, a ₦20M-₦30M property is within reach on this salary.

What is the cheapest area to buy a house in Abuja?

Kuje, Lugbe, and Kubwa consistently offer the lowest entry prices for homebuyers in Abuja. In Kuje, you can find houses from ₦10M. Lugbe offers options from ₦12M, and Kubwa starts around ₦15M for a decent 2-3 bedroom house. These areas are further from the city centre but offer genuine homeownership at prices that are accessible to first-time buyers. Karmo and Dutse are also worth exploring for budget-friendly options.

Do I need a lawyer to buy property in Abuja?

Absolutely, and we cannot stress this enough. A property lawyer protects you from fraud, forged documents, disputed ownership, and legal complications that could cost you your entire investment. Your lawyer will verify the authenticity of title documents, conduct a search at AGIS, draft or review the deed of assignment, and ensure the transaction is legally sound. Legal fees typically run 5-10% of the property value — a worthwhile investment when you consider the alternative. Read more about verifying property titles in Abuja.

How long does it take to buy a house in Abuja?

The timeline varies significantly. A straightforward cash purchase where documents are in order can be completed in 2 to 6 weeks — from initial inspection to key handover. However, the documentation process (obtaining governor’s consent, registering the deed of assignment, and perfecting the title) can take 2 to 6 months or longer. If you are using a mortgage or the NHF, add another 1-3 months for loan processing. Plan for a total timeline of 3-6 months from start to finish for a smooth transaction.

Is it better to buy a new house or an existing one in Abuja?

New houses come with modern finishes, less immediate maintenance, and sometimes developer warranties — but they tend to be pricier and may need finishing (some are sold as “carcass” or semi-finished). Existing (pre-owned) houses are often cheaper, already finished, and located in established neighbourhoods with proven infrastructure — but they may need renovation and could have hidden structural issues. For first-time buyers on a budget, a well-maintained existing house often offers better value. For those who want move-in ready with no surprises, a new build from a reputable developer is the safer choice.

What is the National Housing Fund and how does it help first-time buyers?

The National Housing Fund (NHF) is a government scheme where Nigerian workers contribute 2.5% of their monthly salary into a housing fund. In return, contributors can access a mortgage of up to ₦15 million at just 6% interest per annum, with a repayment period of up to 30 years. This is by far the cheapest mortgage option in Nigeria — commercial bank rates are 18-25%. To qualify, you must have been contributing for at least 6 months and be employed. The loan is accessed through Primary Mortgage Banks accredited by the Federal Mortgage Bank of Nigeria. For more details, see our guide on mortgage options in Nigeria.

Can I buy a house in Abuja without a C of O?

It is possible but risky. A Certificate of Occupancy (C of O) is the highest form of land title in Abuja, issued by the FCT Administration. Some properties are sold with alternative documents like a Right of Occupancy (R of O), allocation letter, or deed of assignment from a previous C of O holder. While these can be legitimate, they carry higher risk. Without a C of O, you may face challenges reselling the property, using it as collateral, or defending your ownership in a dispute. If you must buy without a C of O, ensure your lawyer thoroughly verifies the available documents and initiates the process of obtaining one. Learn more about different types of land title documents in Abuja.

What should I inspect before buying a house in Abuja?

Your inspection checklist should cover: structural integrity (look for cracks in walls and foundations, especially diagonal ones), roof condition (check for leaks, sagging, or damaged roofing sheets), plumbing (run all taps, flush toilets, check for water pressure and drainage), electrical system (test switches, sockets, and the distribution board), drainage (check if water pools around the building after rain), walls and ceilings (look for damp patches, mould, or peeling paint that suggests moisture problems), and fencing and security (assess the perimeter wall, gate, and general security infrastructure). Also inspect the neighbourhood — check road access, proximity to drainage channels, noise levels, and security. We strongly recommend bringing a building professional along for the inspection.

Join The Discussion