Every year, thousands of Nigerians lose millions of naira to property fraud in the Federal Capital Territory. The Abuja real estate market, valued at hundreds of billions of naira, attracts not only serious investors and homebuyers but also a sophisticated network of fraudsters who prey on uninformed buyers. From forged Certificates of Occupancy to ghost estates that exist only in glossy brochures, property scams in Abuja have become alarmingly common and increasingly difficult to detect.

The consequences are devastating. Families lose their life savings. Diaspora Nigerians wire money home for dream homes that never materialise. First-time buyers hand over deposits to “agents” who vanish the following week. According to the Economic and Financial Crimes Commission (EFCC), real estate fraud accounts for a significant share of financial crime complaints in Nigeria, with Abuja ranking among the top hotspots.

But here is the good news: most property scams follow predictable patterns. Once you know the red flags, you can protect yourself and your investment. This guide breaks down the 12 most common scams operating in Abuja right now, shows you exactly how to verify any property before paying a single naira, and explains what to do if you have already fallen victim. Whether you are buying a house in Abuja for the first time or adding to your property portfolio, this is essential reading before you sign anything.

- The 12 Most Common Property Scams in Abuja

- 1. Selling Property That Does Not Belong to the Seller

- 2. Fake Certificate of Occupancy (C of O)

- 3. Selling the Same Property to Multiple Buyers

- 4. Ghost Estates and Phantom Developments

- 5. Inflated Pricing with Hidden Charges

- 6. Bait and Switch

- 7. Encumbered Property

- 8. Selling Government-Acquired Land

- 9. Family Land Disputes

- 10. Fake Agents and Developers

- 11. Survey Plan Manipulation

- 12. Pressure Tactics and Urgency Scams

- How to Verify Property Before Buying in Abuja

- What to Do If You Have Been Scammed

- How to Choose a Legitimate Agent or Developer in Abuja

- Frequently Asked Questions

- What is the most common property scam in Abuja?

- How do I verify a property title in Abuja?

- Can I get my money back if I was scammed?

- Is it safe to buy property in Abuja?

- How do I check if a developer is legitimate?

- What documents should a seller provide before I pay?

- Should I use a lawyer when buying property in Abuja?

- What is the role of AGIS in property verification?

- Are estate agents regulated in Abuja?

- How much does property verification cost in Abuja?

- Ready to Find Your Property?

The 12 Most Common Property Scams in Abuja

1. Selling Property That Does Not Belong to the Seller

This is the oldest and most common property scam in Abuja. Fraudsters, sometimes called “Omonile” or land grabbers, identify a vacant plot or unoccupied property and present themselves as the rightful owner. They produce convincing-looking documents, forge signatures, and even impersonate the actual landowner to complete a sale. In some cases, they collude with local chiefs or area boys who vouch for their “ownership.”

How it works in practice: A seller shows you a beautiful half-plot in Gwarinpa, presents what appears to be a valid deed of assignment, and offers it at a price slightly below market value. You pay, receive documents, and begin planning your build. Three months later, the actual owner shows up with a genuine Certificate of Occupancy and a court order. Your money is gone, and the “seller” has changed phone numbers.

Before paying for any property, you must independently verify ownership through the FCT Land Registry and AGIS. Never rely solely on the documents a seller hands you, no matter how authentic they look.

2. Fake Certificate of Occupancy (C of O)

The Certificate of Occupancy is the highest form of land title in Abuja, issued by the FCT Minister. Because of its legal weight, forging a C of O is extremely lucrative for fraudsters. Modern printing technology has made it possible to produce fakes that are nearly indistinguishable from genuine certificates at first glance, complete with holograms, stamps, and ministerial signatures.

Red flags to watch for: Spelling errors in official text, incorrect plot numbers, mismatched dates (for example, a C of O dated 2008 on paper stock that was not introduced until 2015), and sellers who refuse to let you take the document for independent verification. Some fraudsters even create fake C of O numbers that do not exist in the AGIS database.

The only reliable way to confirm a C of O is to conduct a search at the FCT Land Registry or through AGIS. This search costs between ₦15,000 and ₦50,000 and typically takes 5 to 10 working days. Never skip this step, regardless of how trustworthy the seller appears. Understanding the different types of land title documents in Abuja will also help you spot inconsistencies.

3. Selling the Same Property to Multiple Buyers

This scam is disturbingly common in Abuja. A single plot of land or property is sold to three, four, or even five different buyers simultaneously. The fraudster collects payment from each buyer, issues separate sets of documents (often photocopies with minor alterations), and disappears before anyone discovers the duplication. By the time buyers arrive to take possession, they find multiple people claiming ownership of the same plot.

This scam thrives on secrecy and speed. The fraudster typically targets buyers who are in a rush, buyers from the diaspora who cannot visit the property immediately, and those who skip the verification process. In some cases, a complicit lawyer prepares multiple deeds of assignment for the same property.

To protect yourself, always insist on immediate registration of your deed of assignment at the FCT Land Registry. Visit the property in person before and after payment. Talk to neighbours and ask who owns the plot. If the seller pressures you to “close quickly before someone else takes it,” treat that urgency as a warning sign, not a reason to rush.

4. Ghost Estates and Phantom Developments

Drive along the Abuja airport road or through Lugbe and Kurudu and you will see billboards advertising luxury estates with swimming pools, gyms, and 24-hour security. Some of these estates are legitimate. Others exist only on billboards, brochures, and Instagram pages. Fraudulent developers collect millions in down payments for off-plan properties in estates where no single block has been laid.

The typical pattern: A company registers a flashy name, builds a beautiful website, rents a small office in Wuse or Maitama, and begins aggressive marketing. They offer “pre-launch” prices of ₦25M for units that will “cost ₦45M at completion.” Buyers pay 30% to 60% upfront. Six months pass with no construction. The company blames delays on permits. A year later, the office is empty and the phone numbers are dead.

Before investing in any off-plan development, visit the proposed site. Check if the developer has the land title for that specific location. Verify their registration with REDAN (Real Estate Developers Association of Nigeria). Ask to see completed projects they have built before. If a developer has zero completed projects, your money is at serious risk. Check our guide on how much houses actually cost in Abuja so you can spot pricing that seems too good to be true.

5. Inflated Pricing with Hidden Charges

You find a 4-bedroom duplex in Jahi listed at ₦55M. You agree on the price, pay a deposit, and then the “additional costs” begin: ₦2M for infrastructure levy, ₦1.5M for documentation, ₦500,000 for estate registration, ₦800,000 for “governor’s consent processing,” and ₦1.2M for legal fees that should cost half that amount. By the time you are done, you have paid ₦61M for a property you thought cost ₦55M.

This is not always outright fraud, but it is deceptive and deliberate. Some developers and agents build their profit margin into these “add-on” fees rather than quoting an honest all-inclusive price. Others invent fees that do not exist or inflate legitimate government charges by three to five times the actual amount.

Always ask for a complete breakdown of all costs before making any payment. Get the total cost in writing, including documentation fees, legal fees, agency commission, and any estate-specific charges. Research actual government fees independently. For example, consent fees at the FCT Land Registry are calculated as a percentage of the property value, not a flat arbitrary amount. If any fee cannot be clearly explained and verified, refuse to pay it.

6. Bait and Switch

You visit a show flat or model unit in a new estate development. The finishes are beautiful: granite countertops, solid wood doors, branded sanitary ware, and modern kitchen fittings. You pay for your unit based on what you saw. When you receive your keys months later, you walk into a unit with cheap ceramic tiles, hollow-core doors, plastic taps, and a kitchen that looks nothing like the model you were shown.

In more extreme cases, the switch is not just about quality but about location. A buyer pays for a corner plot in Phase 1 (the developed section) of an estate and is allocated an interior plot in Phase 3 (the undeveloped section with no roads or infrastructure). Some buyers have paid for ground-floor units and been given fourth-floor walkups in buildings with no elevator.

To avoid bait and switch, ensure your purchase agreement specifies exactly what you are buying: the plot number, unit number, floor level, size in square metres, and specification of finishes. Include a clause that allows you to reject the property and receive a refund if what is delivered does not match what was agreed. Never sign a vague agreement that says “similar specification” or “subject to change.”

7. Encumbered Property

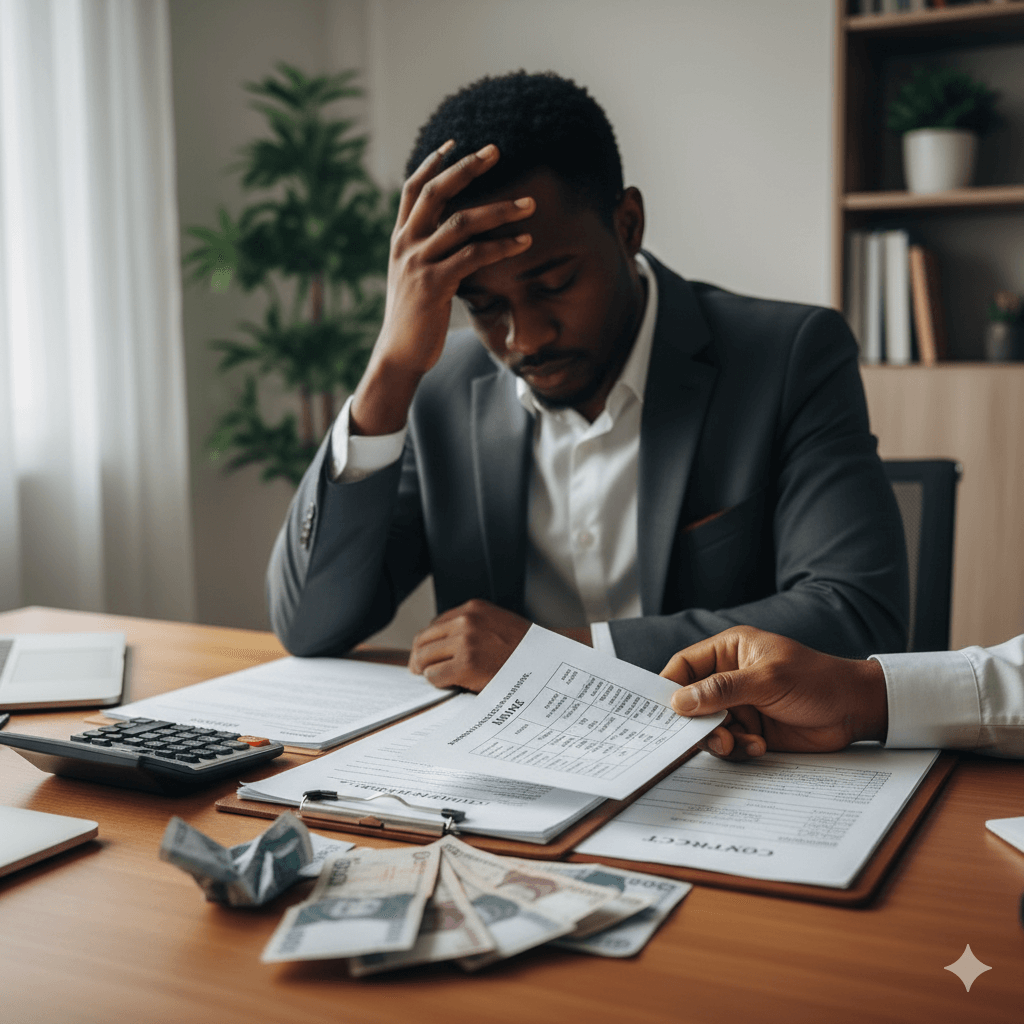

An encumbered property is one that has an existing legal claim, debt, or restriction attached to it. The most common scenario in Abuja is buying a property that is currently under a bank mortgage. The seller collects your money but cannot transfer clean title because the bank holds the property documents as collateral for an outstanding loan. Other encumbrances include caveats (legal warnings filed by someone claiming an interest), court injunctions, and unpaid estate service charges that create liens on the property.

Sellers of encumbered properties are not always fraudulent. Some genuinely intend to use your payment to clear their mortgage and then transfer title. But this creates enormous risk for you. If the seller defaults on their loan or if the bank refuses to release the documents, you are stuck with neither property nor money.

A proper search at the FCT Land Registry will reveal most encumbrances. Ask your lawyer to conduct a litigation search at the courts to check for any pending cases involving the property. If a property is mortgaged, the only safe way to proceed is to pay directly to the bank to settle the mortgage, not to the seller, and to insist on receiving the original title documents from the bank yourself.

8. Selling Government-Acquired Land

Under the Land Use Act, the FCT government can revoke any right of occupancy for “overriding public interest.” When government acquires land for a road project, public building, or infrastructure development, the original allocation is revoked. Fraudsters and sometimes the original allottees themselves continue to sell these revoked plots to unsuspecting buyers who have no idea the land is no longer available for private use.

This is particularly common along new road corridors and expansion areas. As Abuja grows outward, government frequently acquires land in areas like Idu, Karmo, and parts of Lugbe for infrastructure projects. The original allottee may have held a valid C of O five years ago, but that title has since been revoked. The documents they show you are technically real but legally dead.

An AGIS search will typically show whether a property’s title has been revoked. You should also check with the Federal Capital Development Authority (FCDA) for planned development projects in the area. If you are buying land in Abuja, this step is non-negotiable. Buying revoked land means you have no legal claim, and no court will help you.

9. Family Land Disputes

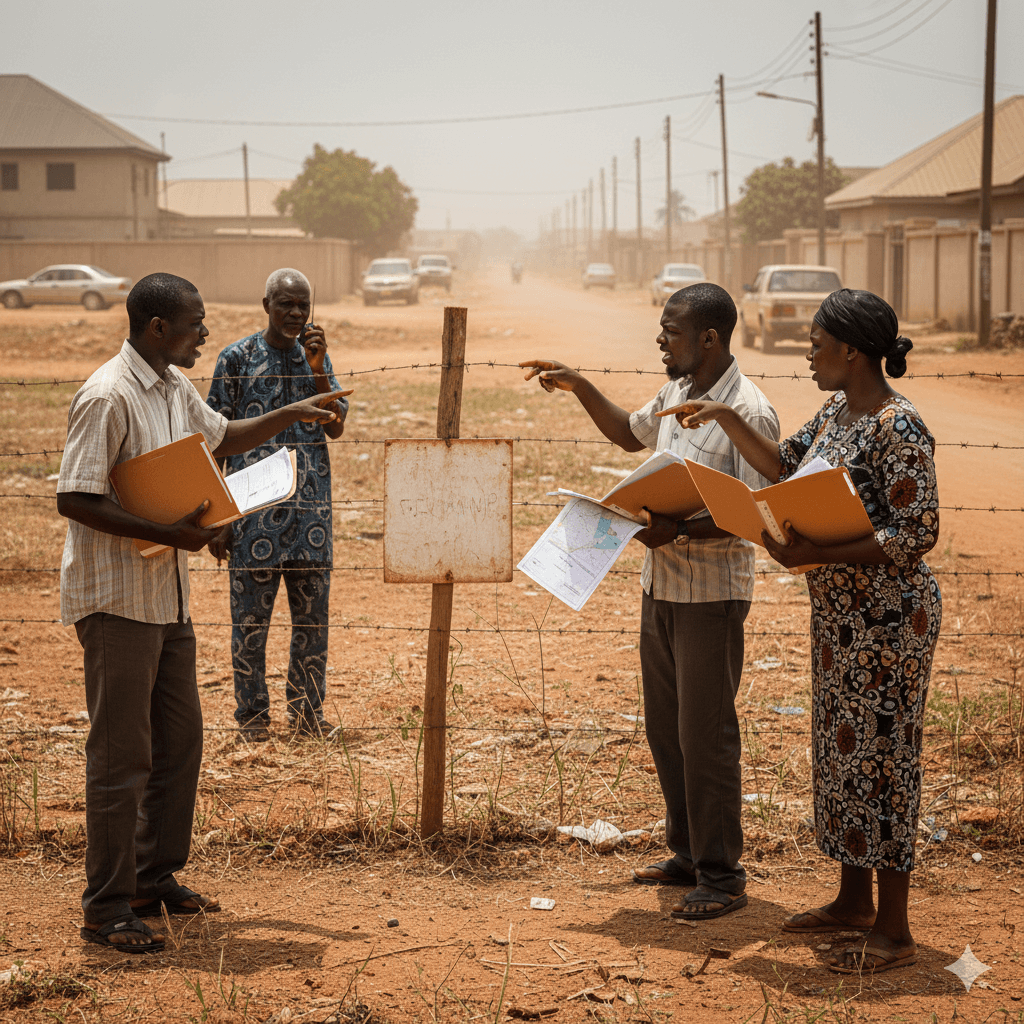

Many properties in Abuja, especially in areas that were originally native settlements such as parts of Karu, Nyanya, Karmo, and Gwagwalada, are held by families rather than individuals. A single family member may decide to sell without the knowledge or consent of siblings, parents, or extended family. You pay, build, and move in. Then other family members show up, claiming they never agreed to the sale and demanding their share of the land.

These disputes can drag on for years in court. Nigerian property law recognises the rights of family members to contest the sale of family land if proper consent was not obtained. Even if you paid full market value and acted in good faith, a court can set aside the sale if the family proves that the seller had no authority to sell on behalf of the family.

When buying property that originates from family or communal ownership, insist on a family resolution or consent document signed by all principal family members. Your lawyer should verify this document and ideally meet with the family. Check whether the land has been converted from customary to statutory title (a proper C of O eliminates most family claims). Buying land in well-established estate areas of Abuja significantly reduces this risk.

10. Fake Agents and Developers

Setting up a fake real estate company in Abuja takes less than a week. Register a business name for ₦15,000, create a website for ₦50,000, rent a desk in a shared office space in Wuse 2, print glossy business cards, and start posting luxury listings on Instagram and Facebook. Some fake agents even list properties on legitimate real estate portals, complete with professional photographs stolen from actual developers’ websites.

These operators are sophisticated. They maintain active WhatsApp Business profiles, respond promptly to enquiries, schedule property viewings (of houses they do not own or represent), and create a convincing sales experience. They collect “commitment fees,” “inspection deposits,” or “booking fees” ranging from ₦200,000 to ₦2M. Once they have collected from enough victims, they shut down their operation and start a new one under a different name.

Before engaging any agent or developer, ask for their ESVARBON (Estate Surveyors and Valuers Registration Board of Nigeria) or REDAN registration number and verify it independently. Check how long they have been in business. Search their company name online for complaints or warnings. Ask for references from at least three previous buyers and actually call those buyers. If an agent cannot provide verifiable credentials and references, do not hand over any money.

11. Survey Plan Manipulation

A survey plan is the technical document that shows the exact location, size, and boundaries of a plot. Scammers manipulate survey plans in several ways: they alter the coordinates to make a survey plan appear to cover a different location; they move physical beacons (the concrete pillars that mark plot boundaries) to expand their plot into neighbouring land; or they present a genuine survey plan for one plot while selling you a completely different piece of land.

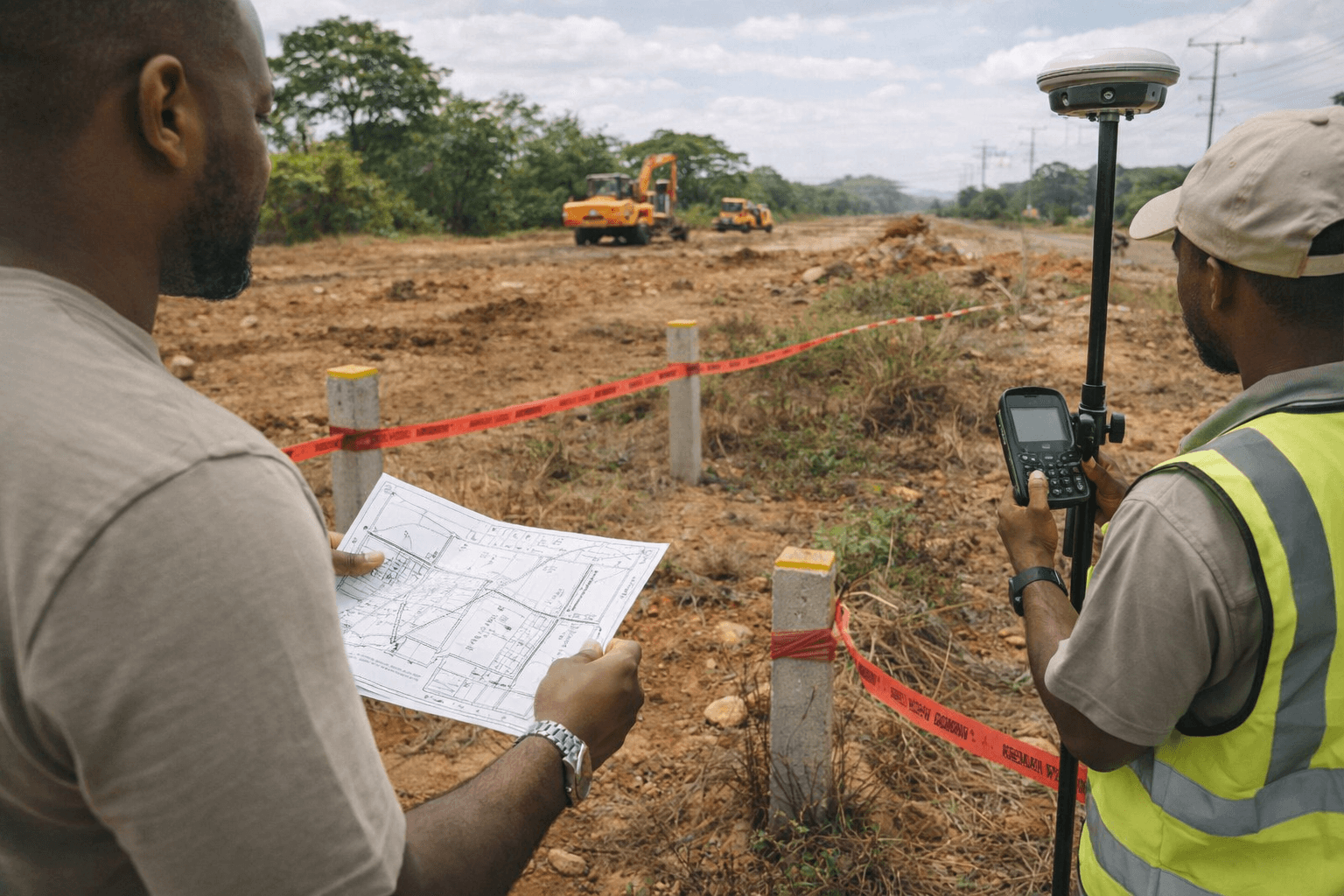

This scam is particularly effective because most buyers cannot read survey plans. The technical data, including coordinates, bearings, and distances, means nothing to the average person. A fraudster can hand you a survey plan for a plot in Katampe and physically take you to a plot in Mpape, and unless you have a surveyor with you, you would never know the difference.

Always hire an independent licensed surveyor to verify the survey plan before you pay. The surveyor should visit the site with GPS equipment and confirm that the coordinates on the plan match the actual location. They should also verify the plan at the Office of the Surveyor General of the Federation. This verification costs between ₦50,000 and ₦150,000 depending on the location, a small price compared to losing millions on the wrong plot.

12. Pressure Tactics and Urgency Scams

“Oga, another buyer is coming with cash tomorrow. If you don’t pay today, you will lose this property.” “This is the last unit at this price. By next week, it goes up by ₦5M.” “The owner is travelling abroad on Friday and won’t sell after that.” If you hear any of these lines, your guard should go up immediately.

Legitimate sellers do not need to create artificial urgency. While genuine demand does exist in popular areas and prices do increase over time, a seller or agent who pressures you to skip due diligence, pay before verification, or decide within hours is almost always hiding something. The urgency is designed to stop you from doing the very checks that would expose the fraud.

Make it a personal rule: you will never pay for any property on the same day you first see it. No matter how good the deal seems, take a minimum of one to two weeks to verify documents, conduct searches, inspect the property, and consult your lawyer. If the property is genuinely available, it will still be there next week. If the seller insists it will not, let it go. There is always another property, but there is no getting back the money you lose to a scam.

How to Verify Property Before Buying in Abuja

Every property transaction in Abuja should follow a strict verification process before any money changes hands. Cutting corners at this stage is how the majority of scam victims end up losing their money. Here is a step-by-step approach to protect yourself.

1. Conduct an AGIS Search. The Abuja Geographic Information Systems (AGIS) maintains a digital database of all land allocations in the FCT. An AGIS search will confirm whether a plot is validly allocated, who the registered owner is, and whether the title has been revoked. You can initiate a search at the AGIS office in Wuse. The fee is approximately ₦15,000 to ₦25,000, and results typically take 5 to 10 working days.

2. Physically Inspect the Property. Never buy a property you have not personally visited. Go to the exact location, confirm that the land matches the description and survey plan, check for any existing structures or signs of occupation by others, and talk to neighbours. Visit at different times of day. If it is a house, inspect the structure with a building professional.

3. Verify the C of O at the FCT Land Registry. Take the Certificate of Occupancy number to the Land Registry in Area 11 and request a certified true copy search. This confirms that the document is genuine, currently valid, and has not been revoked. For a detailed walkthrough of this process, see our guide on conducting a land search and verifying property titles in Abuja.

4. Confirm the Survey Plan. Hire a licensed surveyor to verify that the survey plan coordinates match the physical location of the property. The surveyor should also check the plan at the Office of the Surveyor General to confirm it is registered and valid.

5. Check for Developer and Professional Registration. If you are buying from a developer, verify their registration with REDAN. If dealing with a building project, confirm the professionals involved are registered with COREN (Council for the Regulation of Engineering in Nigeria) or ARCON (Architects Registration Council of Nigeria).

6. Search for Court Cases and Caveats. Your lawyer should conduct a litigation search at the FCT High Court to check whether there are any pending lawsuits, injunctions, or caveats involving the property. This search can reveal disputes that would not appear in an AGIS or Land Registry search.

7. Verify the Seller’s Identity. Confirm that the person selling the property is who they claim to be. Cross-reference their identification documents, confirm their address, and if they claim to be acting on behalf of the owner, demand a properly executed power of attorney verified by your lawyer.

These verification steps may cost you between ₦100,000 and ₦300,000 in total for searches, surveyor fees, and legal fees. That is a tiny fraction of the property’s value and infinitely cheaper than losing your entire investment to fraud. Understand the types of land title documents in Abuja so you know exactly what to ask for and what to verify.

What to Do If You Have Been Scammed

If you suspect or have confirmed that you are a victim of property fraud in Abuja, act quickly. The sooner you take action, the higher your chances of recovering your money or securing the property.

1. Document Everything Immediately. Gather every piece of evidence related to the transaction: receipts, bank transfer confirmations, signed agreements, WhatsApp messages, emails, text messages, photos of the property, business cards, and any other communication. Screenshot digital records before the scammer deletes their accounts. This evidence will be critical for any legal action.

2. Report to the EFCC. The Economic and Financial Crimes Commission handles financial fraud cases, including real estate scams. You can file a petition at their Abuja headquarters in Wuse 2 or submit a complaint online at efccnigeria.org. Include all documentation and provide as much detail as possible about the scammer: full name, phone numbers, bank account details, office address, and any witnesses.

3. File a Petition at the FCT High Court. Through a property litigation lawyer, you can file a civil suit to recover your money and, in some cases, claim damages. If the property was sold to multiple buyers, the court can determine rightful ownership. You can also apply for an injunction to prevent the scammer from selling the property to anyone else while the case is ongoing.

4. Report to the Nigeria Police Force. File a report at the nearest police station and obtain a formal police report. While the police may not always resolve property disputes, a police report creates an official record of the crime and can support your EFCC petition and court case.

5. Engage a Property Litigation Lawyer. Do not try to handle a property fraud case on your own. Hire a lawyer who specialises in property litigation in the FCT. They will know the correct procedures, the right courts, and the most effective legal strategies. Many property lawyers in Abuja offer initial consultations for free or for a modest fee of ₦20,000 to ₦50,000.

6. Alert Other Potential Victims. If you were scammed by a developer or agent, report them to REDAN, ESVARBON, and the Consumer Protection Council. Share your experience (with evidence) on legitimate platforms to warn others. You may find that other victims exist and can join forces for a stronger legal case.

How to Choose a Legitimate Agent or Developer in Abuja

Working with the right professionals is your strongest defence against property scams in Abuja. Here is how to identify trustworthy agents and developers from fraudulent ones.

Check Professional Registration. Legitimate real estate developers in Nigeria should be registered with REDAN. Estate agents should be registered with ESVARBON. Ask for their registration numbers and verify directly with these bodies. Registration is not a guarantee of honesty, but unregistered operators should be treated with extreme caution.

Verify Past Projects. A credible developer will have a track record of completed projects. Ask for the names and locations of estates they have built. Then visit those estates. Talk to residents. Ask whether they received what was promised, whether documentation was handled properly, and whether they would buy from that developer again. A developer who cannot show you a single completed project is a risk you should not take.

Ask for References. Request contact details for at least three previous buyers and call each one. Ask about their experience from start to finish: was the pricing transparent, were there hidden charges, was the property delivered on time, and did they receive proper title documentation? A seller who refuses to provide references is hiding something.

Check Online Presence and Reputation. Search the company name on Google, Nairaland, and social media platforms. Look for complaints, warnings, or scam reports. Check how long their website has been active (a brand-new website for a company claiming 10 years of experience is suspicious). Read Google reviews if available.

Use an Escrow Service for Large Payments. Instead of paying directly to the seller or developer, use a reputable escrow service or pay through your lawyer’s client account. This ensures the money is only released when agreed conditions are met, such as successful title verification and document transfer.

Never Pay 100% Upfront for Off-Plan Properties. Legitimate developers typically structure payments in milestones tied to construction progress: 30% at booking, 30% at foundation completion, 20% at roofing, and 20% at handover. A developer who demands full payment before breaking ground is either desperate for cash flow (a bad sign) or planning to take your money and run. Browse verified house listings on AI Realent to see properties from trusted sellers in Abuja.

Frequently Asked Questions

What is the most common property scam in Abuja?

The most common property scam in Abuja is selling property that does not belong to the seller. Fraudsters identify vacant land or unoccupied properties, produce fake ownership documents, and sell to unsuspecting buyers. Closely related is the practice of selling the same property to multiple buyers simultaneously. Both scams exploit the fact that many buyers do not conduct independent verification at the FCT Land Registry or AGIS before paying. Always verify ownership independently before transferring any money.

How do I verify a property title in Abuja?

To verify a property title in Abuja, start with an AGIS search at the Abuja Geographic Information Systems office to confirm the plot allocation and registered owner. Next, conduct a search at the FCT Land Registry in Area 11 to verify the Certificate of Occupancy. Hire an independent licensed surveyor to confirm the survey plan matches the physical location. Finally, have your lawyer conduct a litigation search at the FCT High Court to check for pending cases or caveats. For a complete step-by-step process, read our detailed guide on conducting a land search and verifying property titles in Abuja.

Can I get my money back if I was scammed?

Recovery is possible but not guaranteed. Your best options are filing a petition with the EFCC, which can investigate and potentially freeze the scammer’s assets, and pursuing a civil suit at the FCT High Court to recover your money plus damages. Success depends on the quality of your evidence (receipts, agreements, messages), whether the scammer can be located, and whether they still have recoverable assets. Acting quickly improves your chances significantly. Engage a property litigation lawyer immediately and file reports with both the EFCC and the police.

Is it safe to buy property in Abuja?

Yes, buying property in Abuja is safe when you follow proper due diligence procedures. Abuja remains one of the most attractive real estate markets in Nigeria, with strong demand and good appreciation potential. The key is to verify every document independently, work with registered professionals, use a lawyer for every transaction, and never rush a purchase. Thousands of legitimate property transactions happen in Abuja every month. Read our complete guide to buying a house in Abuja for a full walkthrough of the safe buying process.

How do I check if a developer is legitimate?

Verify the developer’s registration with REDAN (Real Estate Developers Association of Nigeria) by contacting REDAN directly with the registration number. Visit at least two completed projects by the developer and speak with residents about their experience. Check the company’s registration with the Corporate Affairs Commission (CAC). Search for the company name on Google and Nairaland to find any complaints or scam reports. Ask for references from previous buyers and actually contact them. A legitimate developer will welcome this scrutiny; a fraudulent one will become evasive.

What documents should a seller provide before I pay?

Before making any payment, a seller should provide: the original Certificate of Occupancy (C of O) or Right of Occupancy (R of O), a registered survey plan, a deed of assignment from the previous transaction (if the property has changed hands before), evidence of tax clearance, valid government-issued identification, and proof of address. For estate properties, also request the estate layout plan, building approval, and evidence of the developer’s land title. Never accept photocopies as proof of ownership. Your lawyer should review all documents before you sign anything or transfer money. Learn about the difference between C of O and R of O to understand what each document means.

Should I use a lawyer when buying property in Abuja?

Absolutely, and this is non-negotiable. A qualified property lawyer will conduct due diligence searches, verify all documents, review the terms of sale, draft or vet the deed of assignment, ensure the transaction complies with the Land Use Act, and represent your interests throughout the process. Legal fees for property transactions in Abuja typically range from 5% to 10% of the property value, or a flat fee of ₦150,000 to ₦500,000 depending on the transaction size. This cost is insignificant compared to the millions you could lose without legal protection. Your lawyer should be independent, meaning they should not be the same lawyer recommended by the seller.

What is the role of AGIS in property verification?

AGIS (Abuja Geographic Information Systems) is the FCT government agency responsible for land administration, geographic data management, and spatial information. In property verification, AGIS maintains the official digital database of all land allocations, plot assignments, and title statuses in Abuja. An AGIS search allows you to confirm whether a plot has been validly allocated, identify the registered owner, check if the allocation is still active or has been revoked, and view the approved land use designation (residential, commercial, etc.). AGIS also handles the processing of new land allocations and title registrations. Their office is located in Wuse, and searches can be initiated in person.

Are estate agents regulated in Abuja?

Yes, estate agents and surveyors in Nigeria are regulated by ESVARBON (Estate Surveyors and Valuers Registration Board of Nigeria), which was established by the Estate Surveyors and Valuers Registration Act. To legally practise as an estate agent or surveyor, an individual must be registered with ESVARBON. Real estate developers are represented by REDAN (Real Estate Developers Association of Nigeria), which is a trade association rather than a statutory regulator. However, enforcement of registration requirements remains weak, and many unregistered individuals operate as agents in Abuja. This is why you must always verify an agent’s credentials independently before engaging their services. Ask for their ESVARBON registration number and confirm it directly with the board.

How much does property verification cost in Abuja?

A comprehensive property verification in Abuja typically costs between ₦100,000 and ₦300,000 in total. This includes an AGIS search (₦15,000 to ₦25,000), FCT Land Registry search (₦15,000 to ₦50,000), survey plan verification at the Office of the Surveyor General (₦50,000 to ₦150,000 including surveyor’s professional fees), and a litigation search at the courts (₦20,000 to ₦50,000). Lawyer’s fees for conducting due diligence range from ₦100,000 to ₦300,000 depending on the complexity and property value. While this may seem expensive, it represents less than 1% of most property values in Abuja and is your most important protection against fraud. Before budgeting for your purchase, check current house prices in Abuja and factor in these essential verification costs. Also review the key questions to ask before buying land in Abuja to ensure you cover all your bases.

Join The Discussion