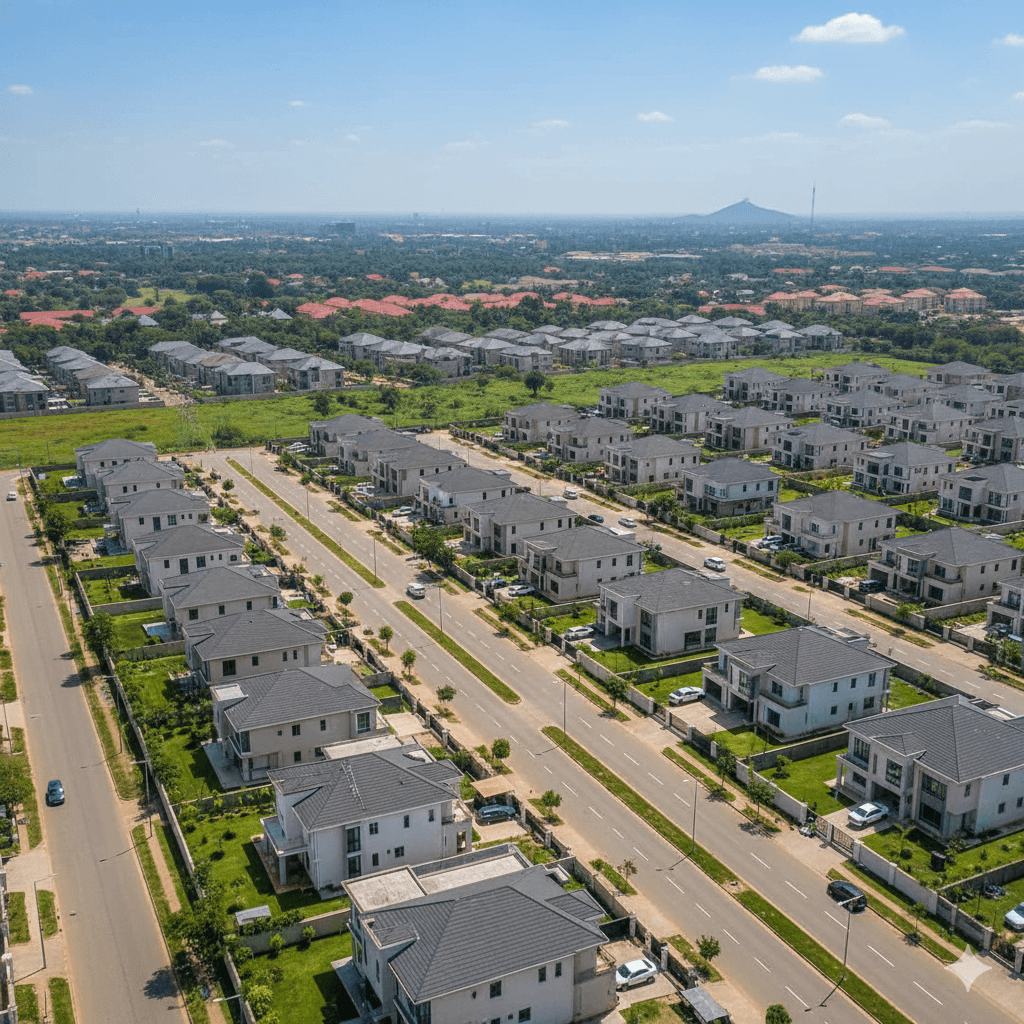

Every year, thousands of Nigerians living in the United States, United Kingdom, Canada, and across Europe make the same decision: it is time to buy property back home. And increasingly, Abuja is where they are looking.

The reasons are compelling. The naira’s depreciation means your foreign currency stretches further than ever. Abuja’s property market is the most regulated in Nigeria, with a centralized land administration system that offers protections you simply will not find in Lagos or state capitals. And whether you are planning for retirement, building generational wealth, or securing rental income, Abuja real estate remains one of the most reliable investments a diaspora Nigerian can make.

But buying property from thousands of miles away comes with real challenges. You cannot inspect the land yourself. You may not know which agents to trust. Stories of diaspora Nigerians losing millions to fraudulent deals are, unfortunately, not rare. The distance creates vulnerability, and bad actors know it.

This guide exists to close that gap. We will walk you through every step of buying property in Abuja from abroad — from choosing the right area and vetting agents remotely, to verifying documents, making secure payments, and managing your property after purchase. If you are reading this from Houston, London, Toronto, or Dubai, consider this your roadmap to a safe and successful property purchase in Nigeria’s capital. For a broader overview of the entire buying process, start with our complete guide to buying a house in Abuja.

- Why Diaspora Nigerians Are Investing in Abuja Property

- Step-by-Step Process to Buy Property in Abuja From Abroad

- How to Verify Property Documents Remotely

- Common Mistakes Diaspora Buyers Make

- Best Areas in Abuja for Diaspora Buyers

- Costs Beyond the Property Price

- Frequently Asked Questions

- Can a Nigerian living abroad buy property in Abuja?

- How do I verify a property in Abuja from overseas?

- Is it safe to send money for property purchase in Nigeria?

- What documents do I need to buy property in Abuja from abroad?

- How much does it cost to buy a house in Abuja?

- Can I get a mortgage for Abuja property while living abroad?

- How do I manage my Abuja property from abroad?

- What is the best area in Abuja for diaspora investment?

- Continue Reading

Why Diaspora Nigerians Are Investing in Abuja Property

The diaspora investment wave into Abuja real estate is not a trend — it is a structural shift driven by economics, sentiment, and opportunity. Here is why it makes sense in 2026.

Naira depreciation works in your favour

With the naira trading at over ₦1,500 to the dollar, properties that cost ₦80 million effectively cost around $50,000 — a fraction of what you would pay for equivalent housing in most Western cities. Your earning power abroad gives you a significant advantage in the Abuja market. A mid-career professional in the UK or US can realistically afford a 3-bedroom house in a well-developed Abuja estate.

Retirement planning and building a home base

Many diaspora Nigerians plan to return home eventually, whether for retirement or to split time between countries. Buying property now — while prices are still accessible — means you will have a home waiting for you. The alternative is returning in 10 years to find that prices have doubled or tripled. If you are moving to Abuja from the USA, having your own property eliminates the stress of house-hunting on arrival.

Rental income and capital appreciation

Well-located properties in Abuja generate rental yields of 5–10% annually, with premium areas like Maitama and Wuse 2 at the higher end due to demand from diplomats, expatriates, and corporate tenants. Meanwhile, emerging areas like Dawaki, Lugbe, and Lokogoma have delivered capital appreciation of 10–25% per year as infrastructure catches up with demand.

Abuja’s regulatory advantage

Unlike Lagos and most state capitals, Abuja’s land administration falls under the Federal Capital Territory Administration (FCTA) through the Abuja Geographic Information Systems (AGIS). This means a single, centralized system for land title registration, verification, and documentation. It is not perfect, but it is the most organized land registry in Nigeria — and that matters enormously when you are buying from abroad and cannot physically verify everything yourself.

Step-by-Step Process to Buy Property in Abuja From Abroad

Buying property remotely requires more discipline and structure than buying in person. Follow these eight steps to protect yourself and ensure a smooth transaction.

Step 1: Define your budget and purpose

Before you start browsing listings, get clear on two things: how much you can spend (total, including all fees) and what the property is for. A property for personal use when you retire has different requirements than one you want to rent out immediately. Investment properties should prioritize location and tenant demand. Personal-use properties should prioritize the lifestyle and infrastructure you want. Your budget should include not just the purchase price but also legal fees, registration costs, and agency commission — which can add 15–25% on top. For a detailed breakdown, see our guide on how much houses cost in Abuja.

Step 2: Choose the right area

Abuja is a large city with vastly different neighbourhoods. Where you buy determines your returns, your tenant pool, and your long-term experience. We have a detailed breakdown of the best areas to buy a house in Abuja that covers every major district. From abroad, prioritize areas with proven infrastructure — paved roads, electricity supply, and water. Avoid buying in areas that are “up and coming” unless you have someone on the ground who can confirm that development is actually happening.

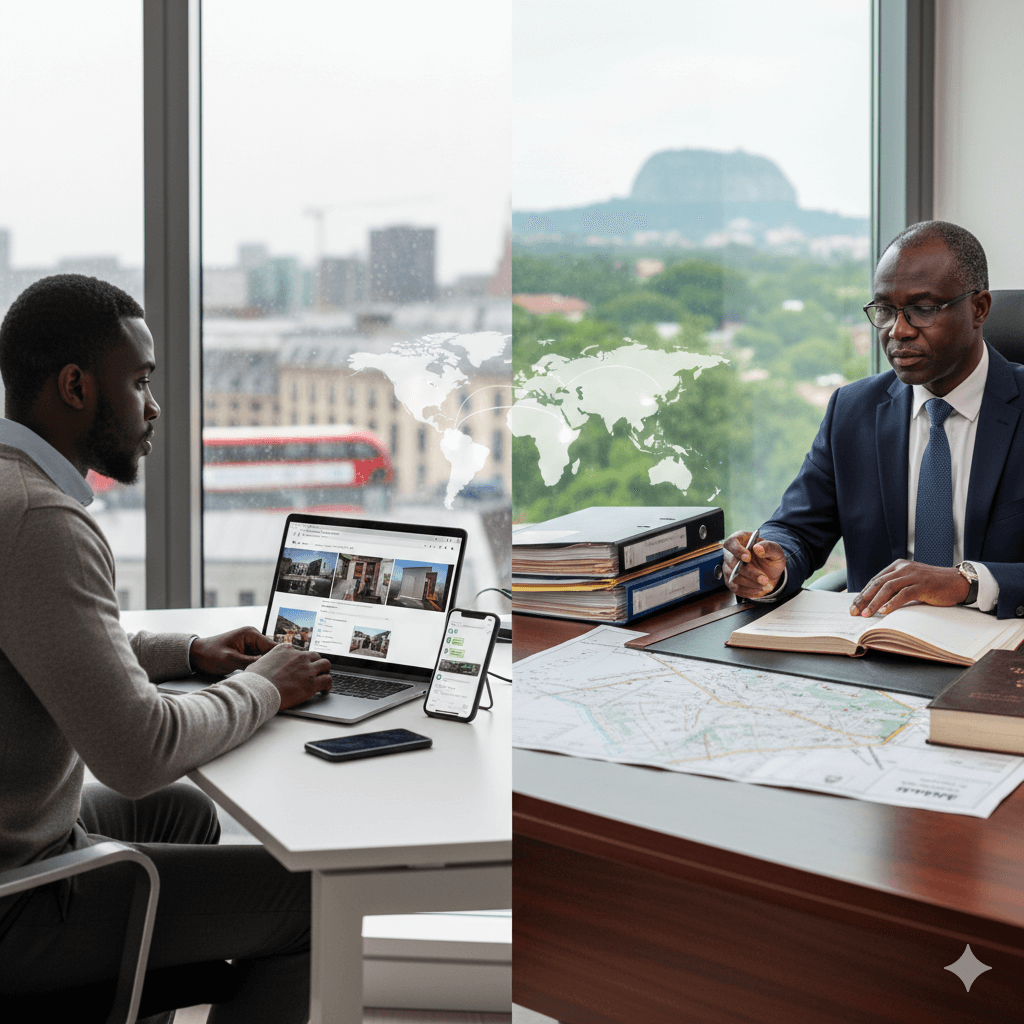

Step 3: Find a reputable agent or developer

This is where most diaspora purchases go right or wrong. To vet an agent remotely:

- Check if they are registered with the Estate Surveyors and Valuers Registration Board of Nigeria (ESVARBON) or the Nigerian Institution of Estate Surveyors and Valuers (NIESV)

- Ask for references from previous diaspora clients you can contact directly

- Verify their physical office address on Google Maps and request a video call from the office

- Search their name and company on social media, Nairaland, and Google for complaints or fraud reports

- Start with a small engagement (like a paid property inspection) before committing large sums

You can also browse verified listings on our houses for sale in Abuja and land for sale in Abuja pages to compare options and prices.

Step 4: Conduct due diligence

Never pay for any property without completing due diligence first. This means verifying that the seller actually owns the property and has the legal right to sell it. Your lawyer (Step 5) should handle this, but you need to understand what is being checked. We cover this in detail in our guide to conducting a land search and verifying property titles in Abuja. At minimum, insist on verification of the Certificate of Occupancy (C of O), confirmation that the property is not under litigation, and a physical inspection with photos and video sent to you.

Step 5: Engage a lawyer in Abuja

Hire an independent property lawyer based in Abuja — not one recommended by the seller or agent. Your lawyer should conduct the title search at AGIS, review all documentation, draft the sale agreement, and represent your interests through to completion. Expect to pay 5–10% of the property value in legal fees. This is not the place to cut costs. A good lawyer is the single most important investment you will make in this process.

Step 6: Make payment securely

How you send money matters enormously. Best practices include:

- Use an escrow service — several Nigerian fintech companies now offer property escrow, holding your funds until documentation is verified and conditions are met

- If paying by bank transfer, send funds to the seller’s company account (not a personal account) and ensure the payment purpose is clearly documented

- Never pay the full amount upfront — structure payments in milestones tied to documentation completion

- Keep records of every transfer, receipt, and communication

- Avoid cash payments or sending money through informal channels, no matter how trusted the intermediary claims to be

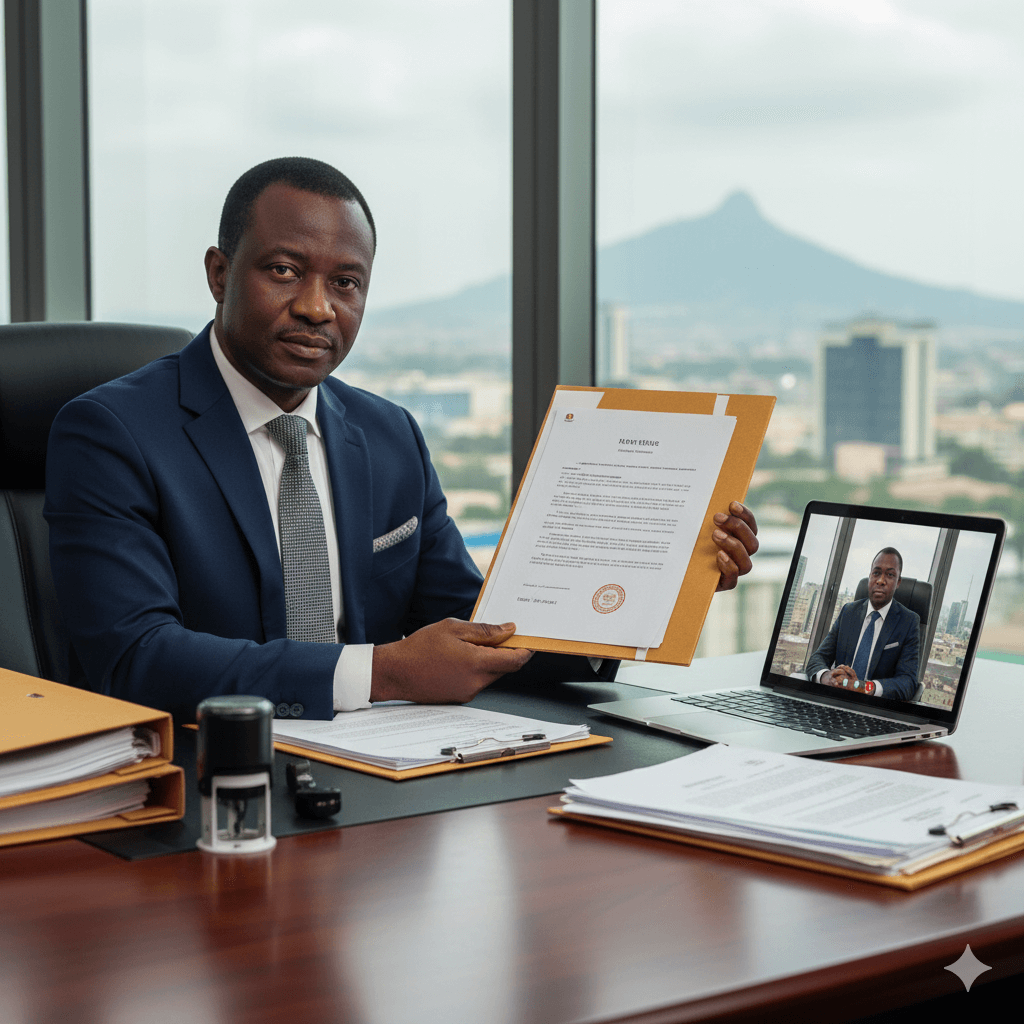

Step 7: Documentation and registration

After payment, ensure the following documents are properly executed and registered:

- Deed of Assignment — the legal document transferring ownership from seller to you

- Certificate of Occupancy (C of O) — the highest form of land title in Nigeria, issued by the government

- Governor’s Consent — required for the transfer of any property with a C of O to be legally valid

- Survey Plan — the official document showing the exact boundaries and coordinates of the property

- Building Approval — if buying a built property, confirm it has approved building plans

Your lawyer should handle the registration at AGIS and ensure you receive certified copies of all documents. For a checklist of what to ask before purchasing, see our guide on questions to ask before buying land in Abuja.

Step 8: Arrange property management

If you will not be living in Nigeria, you need someone to manage the property. This is especially important for rental properties. A professional property management company will handle tenant sourcing, rent collection, maintenance, and inspections. Fees typically run 10–15% of annual rent. Alternatively, some buyers designate a trusted family member, but we strongly recommend formalizing this arrangement with a written agreement and regular reporting.

How to Verify Property Documents Remotely

Document verification is the most critical step in any property transaction — and the most challenging to do from abroad. Here is how to approach it systematically.

AGIS verification

The Abuja Geographic Information Systems (AGIS) is the central authority for land records in the FCT. Your lawyer can conduct a search at AGIS to confirm whether a property’s Certificate of Occupancy is genuine, whether the land is designated for the use the seller claims (residential, commercial, etc.), and whether there are any encumbrances or disputes on the title. No property purchase in Abuja should proceed without an AGIS search. The process typically takes 2–4 weeks and costs between ₦50,000 and ₦150,000.

Checking C of O authenticity

A Certificate of Occupancy should bear the signature of the FCT Minister, have a unique registration number verifiable at AGIS, and match the survey plan coordinates of the property being sold. Ask your lawyer to obtain a certified true copy from AGIS rather than relying on the seller’s copy alone. Forged C of Os exist, and they can be convincing. The only reliable verification is through the issuing authority.

Survey plan verification

The survey plan should be prepared by a registered surveyor and filed with the Office of the Surveyor General. Your lawyer can verify that the plan’s beacon numbers are registered and that the coordinates match the actual property. This step catches a common fraud tactic: sellers showing you one piece of land but providing documents for a different (often less valuable) plot. For a comprehensive walkthrough, read our guide on conducting a land search and verifying property titles in Abuja.

Request video and photo evidence

While your lawyer handles the legal verification, you should also request a live video call or recorded walkthrough of the property. Ask to see the property from the road, the surrounding neighbourhood, and any landmarks. Cross-reference what you see with Google Maps satellite imagery. If the seller or agent resists providing visual evidence, treat that as a serious red flag.

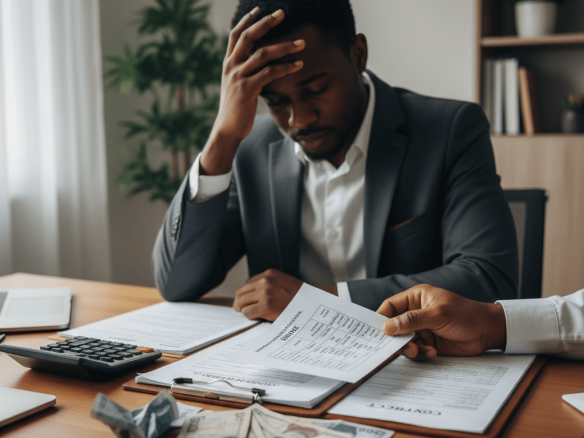

Common Mistakes Diaspora Buyers Make

Learning from the mistakes of others is far cheaper than making your own. These are the most frequent errors we see diaspora buyers make when purchasing property in Abuja.

Sending money without verifying the title

This is the number one mistake, and it accounts for the majority of diaspora property fraud cases. Excitement, pressure from the seller claiming other buyers are interested, or trust in a family connection leads people to transfer money before their lawyer has completed due diligence. No legitimate seller will lose a deal because you took 3–4 weeks to verify documents. If they pressure you, walk away.

Buying through relatives without legal backing

Asking a brother, cousin, or uncle to “handle everything” without a formal power of attorney, written agreement, or independent oversight is a recipe for disputes. Family relationships are important, but property transactions need legal structure. At minimum, your relative should work alongside a lawyer you hired independently.

Not using an escrow service

Sending ₦30 million directly to a seller’s bank account gives you no recourse if something goes wrong. Escrow services hold your funds and release them only when pre-agreed conditions are met. The small fee (typically 1–2.5% of the transaction value) is worth the protection, especially for first-time buyers.

Ignoring infrastructure

A plot of land may be cheap, but if there are no roads, no electricity infrastructure, and no water supply within the development, you will spend millions more to make it livable — or find it nearly impossible to rent out. Always verify the current state of infrastructure, not just the developer’s promises about future development.

Not budgeting for additional costs

The advertised price is never the final cost. Budget an additional 15–25% for legal fees, agency commission, survey and documentation, registration, and governor’s consent. Diaspora buyers who budget only for the property price often find themselves unable to complete the transaction or forced to cut corners on critical steps like proper documentation. Our property investment guide for beginners covers all the costs you should plan for.

Best Areas in Abuja for Diaspora Buyers

The right area depends entirely on your purpose. Here is how to think about location based on your investment goal. For a deeper analysis, explore our Abuja area guides.

For personal residence (when you return to Nigeria)

If you are buying a home to live in — whether after retirement or when you relocate — prioritize Gwarinpa, Jahi, and Life Camp. These areas offer modern estate living with good road networks, reliable infrastructure, and a growing ecosystem of schools, hospitals, supermarkets, and recreational facilities. Gwarinpa is one of the largest housing estates in West Africa and has a strong sense of community. Jahi and Life Camp are slightly more upscale, with newer developments and proximity to commercial centres. Prices for a 3–4 bedroom detached house range from ₦60 million to ₦150 million depending on the estate and finishing quality.

For rental income

Wuse 2, Maitama, and Garki are the top choices for rental returns. These areas sit in the heart of Abuja and attract the highest-paying tenants — diplomats, expatriate workers, senior government officials, and multinational corporation staff. Annual rents for a 3-bedroom flat in Wuse 2 range from ₦3.5 million to ₦7 million. In Maitama, expect ₦5 million to ₦12 million for similar properties. The entry prices are higher (₦80 million to ₦250 million+), but the rental yields and tenant quality justify the premium. Browse available options in our houses for sale listings.

For capital appreciation

If your primary goal is to buy now and benefit from price growth over the next 5–10 years, look at Dawaki, Lugbe, and Lokogoma. These areas are still relatively affordable — you can find land from ₦10 million to ₦25 million and houses from ₦35 million to ₦70 million — but they are developing rapidly. New roads, housing estates, and commercial facilities are being built continuously. Early buyers in areas like Dawaki have seen property values double in just 3–4 years. Check available land listings in Abuja for current prices. For a complete pricing breakdown by area, see our analysis of how much houses cost in Abuja.

Costs Beyond the Property Price

One of the biggest surprises for diaspora buyers is how much extra the total purchase costs beyond the listed price. Here is a realistic breakdown of additional expenses you should budget for.

Legal fees

Your lawyer’s fees typically range from 5–10% of the property value, covering due diligence, documentation drafting, AGIS searches, and registration. For a ₦50 million property, expect to pay ₦2.5 million to ₦5 million in legal costs. Some lawyers charge a flat fee for specific services, so get a detailed quote upfront.

Agency commission

Estate agents typically charge 5–10% of the property price as commission. In many cases, this is paid by the buyer. Clarify this before engaging an agent, and ensure the commission structure is documented in writing.

Survey and documentation

A fresh survey plan costs between ₦200,000 and ₦500,000 depending on the plot size and location. Additional documentation costs — including stamp duty, registration fees, and certified copies — can add another ₦200,000 to ₦400,000.

Governor’s consent

If the property has an existing C of O being transferred to you, governor’s consent is legally required. The official fee is a percentage of the property value (typically 3–6%), but the process can also involve administrative costs. Budget ₦1 million to ₦5 million depending on property value, and expect the process to take several months.

Annual land use charge

After purchase, you will pay an annual ground rent and land use charge to the FCTA. These are relatively modest — typically ₦10,000 to ₦100,000 per year depending on the property size and location — but failure to pay can create legal complications down the road.

Property management fees

If you hire a property management company to handle your rental property, expect fees of 10–15% of annual rent. For a property generating ₦4 million per year in rent, that is ₦400,000 to ₦600,000 annually. This covers tenant management, rent collection, routine maintenance coordination, and periodic inspections.

Frequently Asked Questions

Can a Nigerian living abroad buy property in Abuja?

Yes, absolutely. Nigerian citizens retain the right to own property in Nigeria regardless of where they live. There are no legal restrictions on diaspora Nigerians purchasing land or houses in Abuja. You can buy property using a power of attorney if you cannot travel for the transaction, or you can complete the process during a visit. The key requirement is that you follow the proper legal process — engage a lawyer, verify documents, and register the property in your name at AGIS.

How do I verify a property in Abuja from overseas?

The most reliable method is to hire an independent property lawyer based in Abuja to conduct a title search at AGIS on your behalf. Your lawyer will verify the Certificate of Occupancy, check for encumbrances or litigation, and confirm that the seller has the legal right to sell. You should also request a video walkthrough of the property and cross-reference the location with satellite imagery. Read our detailed guide on conducting a land search and verifying property titles in Abuja for the full verification process.

Is it safe to send money for property purchase in Nigeria?

It can be safe if you take the right precautions. Use an escrow service to hold funds until all conditions are met. Never send the full payment upfront — structure payments in milestones tied to document verification and registration progress. Transfer funds to a company account (not a personal account), and ensure every transfer is documented with a clear statement of purpose. Avoid informal money transfer channels. With these safeguards in place, thousands of diaspora Nigerians successfully complete property transactions every year.

What documents do I need to buy property in Abuja from abroad?

You will need a valid Nigerian passport or national ID for identification, a power of attorney (if someone is acting on your behalf in Nigeria), proof of funds or evidence of payment, and two recent passport photographs. Your lawyer will prepare the deed of assignment and handle the application for governor’s consent and registration at AGIS. After the transaction, you should receive the deed of assignment, C of O (or application receipt), survey plan, building approval (for developed properties), and evidence of payment of ground rent.

How much does it cost to buy a house in Abuja?

House prices in Abuja vary significantly by area and property type. A 3-bedroom house ranges from ₦35 million in emerging areas like Lugbe and Dawaki to over ₦250 million in premium districts like Maitama. In dollar terms, that is roughly $23,000 to $165,000 at current exchange rates. Beyond the purchase price, budget an additional 15–25% for legal fees, agency commission, documentation, and registration. For a complete area-by-area price breakdown, see our detailed analysis of how much a house costs in Abuja.

Can I get a mortgage for Abuja property while living abroad?

Mortgage options for diaspora Nigerians are limited but growing. The Federal Mortgage Bank of Nigeria (FMBN) has a diaspora mortgage product, and some commercial banks like GTBank and Access Bank offer mortgage facilities to Nigerians abroad, though the requirements are stringent. You will typically need to provide proof of income from your country of residence, a Nigerian bank account, and a significant down payment (20–40%). Interest rates range from 12–20% per annum, which is considerably higher than Western mortgage rates. Many diaspora buyers find it more cost-effective to save and pay outright rather than take on a naira-denominated mortgage.

How do I manage my Abuja property from abroad?

The most reliable option is to engage a professional property management company in Abuja. They will handle tenant screening, lease agreements, rent collection, property maintenance, and provide you with regular reports and financial statements. Fees range from 10–15% of annual rental income. Alternatively, you can designate a trusted person in Abuja, but formalize the arrangement with a written management agreement that outlines responsibilities, reporting frequency, and financial accountability. Whichever option you choose, insist on monthly or quarterly updates with photos of the property.

What is the best area in Abuja for diaspora investment?

The best area depends on your investment objective. For rental income, Wuse 2 and Maitama offer the highest yields due to demand from diplomats and expatriates. For capital appreciation, Dawaki, Lugbe, and Lokogoma are delivering 10–25% annual growth at lower entry prices. For a personal home when you return, Gwarinpa, Jahi, and Life Camp offer the best combination of modern living and community infrastructure. We break down every major area in our guide to the best areas to buy a house in Abuja.

Join The Discussion